candlestick patterns have been a fundamental component of technical analysis. The Shooting Star candlestick pattern is one of the most accurate ways to forecast possible market reversals. Knowing this pattern will help you make more informed trading decisions whether you trade commodities, equities, FX, or cryptocurrencies. Everything you need to know about the Shooting Star, including its formation, interpretation, benefits, drawbacks, and useful tactics, will be covered in this thorough book.

What is a Shooting Star Candlestick Pattern?

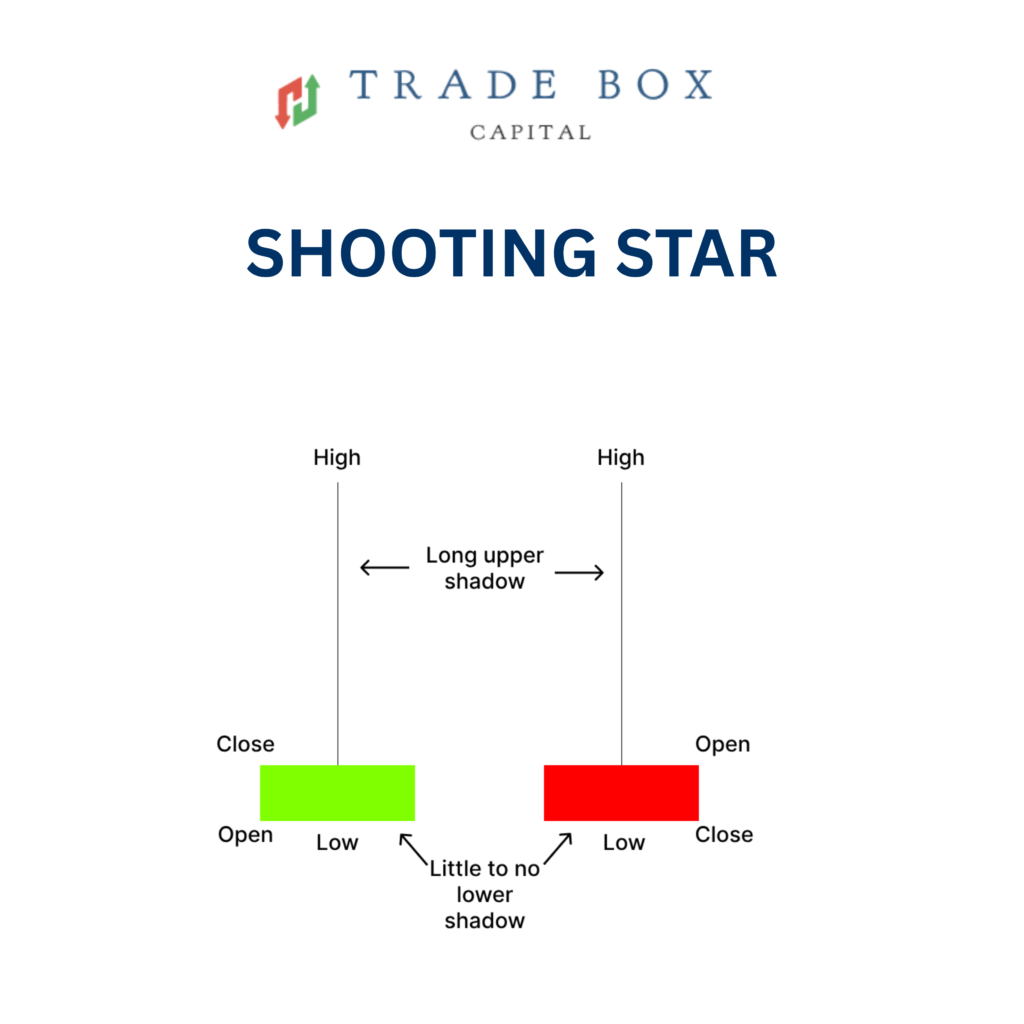

A single candlestick pattern known as a “Shooting Star” indicates a possible uptrend reversal. It typically follows a significant bullish movement and suggests that a bearish shift in the market may be imminent. The design is distinguished by:

- Small real body near the bottom of the candle

- Long upper shadow at least twice the size of the body

- Little or no lower shadow

The long top shadow shows that buyers tried to boost the price, but sellers pushed back, lowering it to the starting price. This implies that there could not be as much upward momentum.

Structure of a Shooting Star

Understanding the anatomy of the Shooting Star is crucial for identifying it correctly:

1.Real Body:

- The real body represents the difference between the opening and closing price.

- It is small and located near the lower end of the candlestick.

2.Upper Shadow (Wick):

- This is the most important feature.

- Indicates the high of the trading session and shows strong selling pressure that overcame buyers.

3.Lower Shadow:

- Usually minimal or nonexistent.

- Confirms that sellers dominated the market toward the close.

How to Identify a Shooting Star

Correct identification is essential to avoid false signals. Look for these criteria:

1. Trend Context:

- Must occur after an uptrend. A Shooting Star in a downtrend is generally meaningless.

- Ideally, the preceding uptrend should be significant enough to make a potential reversal noteworthy.

2. Shadow Ratio:

- The upper shadow should be at least 2-3 times the size of the body.

- A longer upper shadow indicates that buyers tried to push the price higher but failed, showing selling pressure.

3. Color of the Body:

- The body can be bullish (green/white) or bearish (red/black).

- Bearish bodies indicate stronger reversal potential, but even bullish bodies can signal caution if the upper shadow is long enough.

4. Volume Confirmation:

- Higher trading volume during the formation strengthens the reliability of the pattern.

- Low volume may indicate weak selling pressure, reducing the chance of a significant reversal.

5.Close Price Position:

- The closing price should be near the low of the day/session.

- A close near the high weakens the Shooting Star signal.

6. Prior Candlestick Patterns:

- Look for preceding strong bullish candles to confirm the trend context.

- A Shooting Star following a series of small indecisive candles may not be as reliable

7. Multiple Timeframe Analysis:

- Check higher timeframes to confirm the reversal signal.

- A Shooting Star on a daily chart is more significant than one on a 5-minute chart

8.Candle for Verification:

- Wait until the next candle closes lower to confirm the reversal.

- Making a transaction just after a Shooting Star without receiving confirmation could lead to false signals.

Psychology Behind the Shooting Star

The Shooting Star reflects a shift in market sentiment:

- Initial Bullish Momentum: Throughout the session, buyers raise the price.

- Seller Intervention: In order to reject the higher price, sellers forcefully enter the market close to the top.

- Closing Close to the Open: A possible bearish reversal is indicated when buyers lose control.

- Market Hesitancy: The market tests higher prices but eventually rejects them, as indicated by the extended upper shadow.

In essence, it’s a visual representation of market hesitation and rejection of higher prices.

Shooting Star vs Inverted Hammer

While both patterns look similar, context differentiates them:

| Feature | Shooting Star | Inverted Hammer |

| Trend Context | Appears after uptrend | Appears after downtrend |

| Signal Type | Bearish reversal | Bullish reversal |

| Shadow Length | Long upper shadow | Long upper shadow |

| Body Position | Near bottom | Near bottom |

Trading the Shooting Star Pattern

Traders can use the Shooting Star in several ways:

1. Confirmation

- Await the next candlestick to close beneath the body of the shooting star.

- This lessens false signals and verifies that sellers have taken charge.

2. Points of Entry

- Sell Short: After confirmation, enter with a stop-loss above the Shooting Star’s peak.

- Sell Current Long Positions: Tighten stop-losses or take profits based on the pattern.

3. Risk Management

- Stop-Loss Placement: Above the high of the Shooting Star.

- Position Sizing: Smaller position size may be safer in volatile markets.

4. Combining with Indicators

- Moving Averages: Look for Shooting Stars near resistance levels.

- RSI (Relative Strength Index): Overbought conditions strengthen the reversal signal.

- MACD: Divergence with MACD can confirm trend weakening.

Advantages of the Shooting Star Candlestick Pattern

- Easy to Identify: Clear structure makes it beginner-friendly.

- Works Across Timeframes: Applicable in intraday, daily, weekly, or monthly charts.

- Versatile Across Markets: Effective in stocks, forex, crypto, and commodities.

- Early Reversal Signal: Helps traders spot potential market tops early.

- Supports Risk Management: Clear stop-loss and target levels can be defined.

Limitations of the Shooting Star

- Not 100% Accurate: Can fail, especially in strong bullish trends.

- Requires Confirmation: Acting on a single candle is risky.

- False Signals: Can occur due to market noise.

- Better with Other Indicators: Works best when combined with RSI, MACD, or support/resistance levels.

- Short-Term Focus: May not be reliable for long-term trend predictions.

Practical Examples

Company: Reliance Industries Ltd. (NSE: RELIANCE)

Scenario:

Reliance Industries is in a strong daily uptrend, making higher highs and higher lows. The stock has rallied consistently for several sessions and is approaching a major resistance zone near ₹2,950.

Observation:

At the resistance level, a Shooting Star candlestick forms on the daily chart.

- The candle has a small real body near the bottom

- A long upper shadow, nearly three times the body

- Very little lower shadow

- Volume is higher compared to previous sessions

This indicates that buyers attempted to push the price higher, but strong selling pressure emerged near resistance.

Action:

- Wait for confirmation on the next trading day

- The following candle closes below the Shooting Star’s body, confirming bearish momentum

- This provides a potential short-selling opportunity or an exit signal for long positions

- Stop-loss: Above the high of the Shooting Star

- Target: Previous support or short-term moving average

Tips for Trading Shooting Star

- Always Consider the Trend: Never trade against a notable fall with a shooting star.

- Keep a watch out for overbought conditions and resistance zones while using technical indicators.

- Make Use of Volume Analysis: High volume increases reliability.

- Avoid trading in low-liquidity markets as patterns may produce misleading suggestions.

- Keep the Risk-Reward Ratio Correct: A ratio of at least 1:2 is recommended.

Common Mistakes to Avoid

- Ignoring trend context.

- Trading without confirmation.

- Relying solely on the candlestick pattern.

- Placing stop-loss too tight or too loose.

- Overlooking market fundamentals in volatile environments.

Conclusion

The Shooting Star candlestick pattern is one of the best tools accessible to traders.It graphically shows a shift in market mood and suggests a potential reversal after a favorable trend.Traders can enhance their decision-making and risk management by comprehending its psychology, history, and appropriate trading tactics.

But success is not assured by any candlestick pattern. To maximize its effectiveness, the Shooting Star must be used in conjunction with other technical indicators, trend analysis, and appropriate risk management.

The Shooting Star pattern can be a very useful tool in your trading journey if you practice, be patient, and apply discipline.