Introduction

The study of price behavior on charts is known as technical analysis. Candlestick patterns, which graphically depict market mood over a given time period, are among the most used tools in technical analysis. These patterns aid students and analysts in comprehending the interactions between buyers and sellers in the marketplace.

Among bearish candlestick formations, the Three Black Crows Candlestick Pattern is said to be one of the most evident signs of ongoing selling pressure. Commodities, stocks, indices, forex, and cryptocurrency markets all regularly conduct research on it.

This extensive teaching resource covers the Three Black Crows pattern’s importance, structure, psychology, chart examples, comparison with other similar patterns, advantages, disadvantages, and analytical interpretation.

What Is the Three Black Crows Candlestick Pattern?

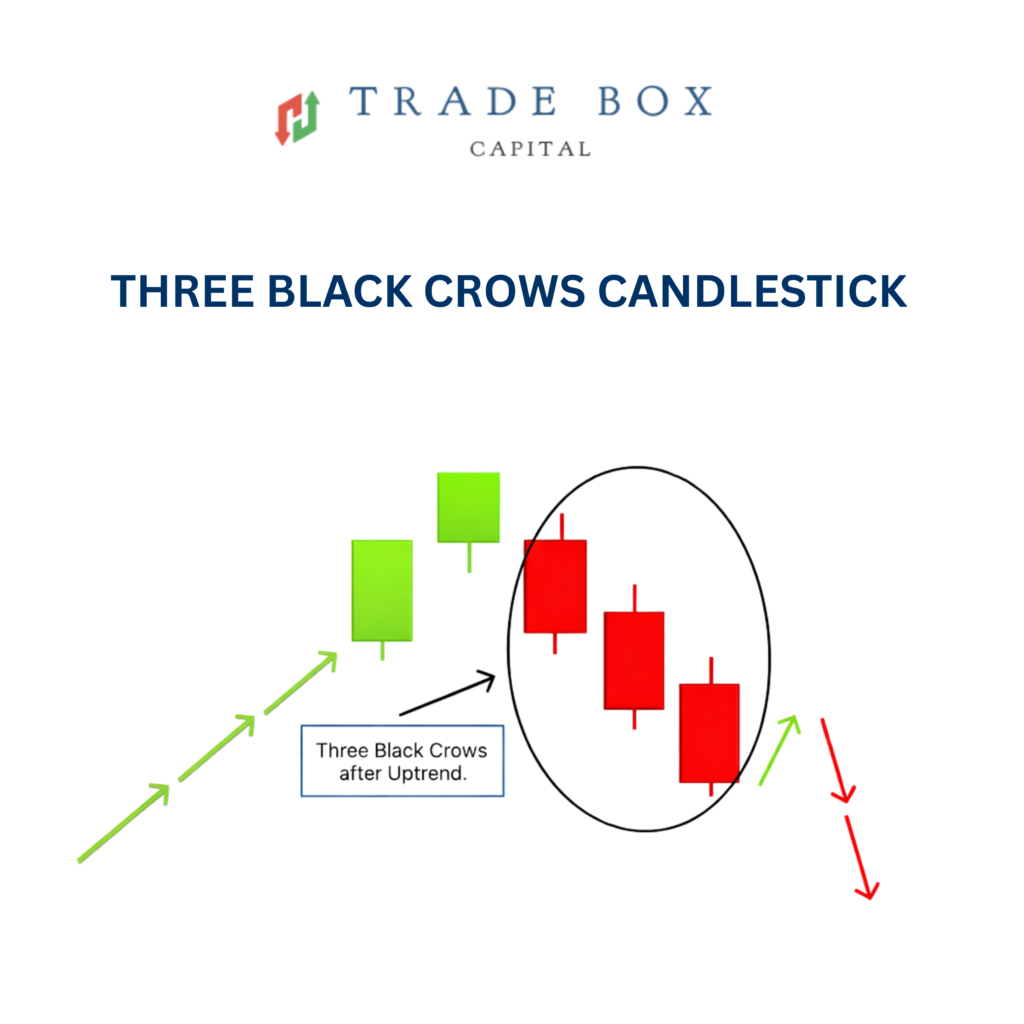

Three Black Crows Candlestick Pattern is a bearish candlestick formation that appears after a sustained uptrend. It consists of three consecutive bearish candles, each closing lower than the previous one.

From a technical analysis perspective, this pattern suggests that bullish momentum is weakening and selling pressure is increasing consistently over multiple sessions.

Key Educational Characteristics:

- Forms after an uptrend

- Consists of three bearish candles

- Each candle opens near the previous close

- Each candle closes near its session low

- Shows minimal upper or lower shadows

Why Is It Called “Three Black Crows”?

Historically, candlestick charts used black candles to represent bearish price movement and white candles to represent bullish movement. The term “crows” is symbolic and traditionally associated with caution or warning.

Three consecutive black candles appearing after an uptrend are interpreted as a warning sign of growing bearish sentiment.

Market Psychology Behind the Three Black Crows Pattern

Understanding market psychology is essential for interpreting candlestick patterns correctly.

First Black Crow:

The first bearish candle usually appears after a strong rally. Many market participants consider it a normal pullback or profit booking.

Second Black Crow :

The second bearish candle confirms that selling pressure is not temporary. Buyers begin to hesitate, and confidence in the uptrend weakens.

Third Black Crow :

The third bearish candle indicates strong control by sellers. Market sentiment shifts more decisively, and caution increases among buyers.

This gradual progression makes the Three Black Crows pattern are presentation of sustained sentiment change, not a sudden reaction.

Structure and Identification Rules

For educational purposes, analysts typically look for the following structure

1. A clearly defined prior uptrend

2. Three consecutive bearish candles

3. Long real bodies indicating strong selling

4. Candle opens within or near the previous candle’s body

5. Candle closes near the session low

When these conditions are met, the pattern is considered structurally valid.

Candle Formation Explanation

Three consecutive long bearish (red/black) candles that emerge following an upswing or close to a market peak make up the Three Black Crows pattern.

Strong selling pressure is evident as each candle opens inside the actual body of the preceding candle and gradually closes lower.

Key characteristics:

- All three candles have long real bodies and small or no lower shadows

- Each candle closes near its low

- Opens are typically within the previous candle’s body

- Appears after a bullish trend or consolidation

- This formation visually represents a gradual but firm takeover of control by sellers.

How the Pattern Works

The pattern works by signaling a shift in market sentiment from bullish to bearish:

- The first candle indicates initial profit booking or selling pressure

- The second candle confirms that sellers are gaining confidence

- The third candle shows strong bearish dominance and reduced buying interest

As each candle closes lower than the previous one, it confirms that buyers are unable to push prices higher, increasing the probability of a trend reversal or further downside continuation.

Traders often wait for confirmation through volume expansion or a breakdown of a key support level before taking positions.

Market Significance

The Three Black Crows pattern is considered a strong bearish reversal signal, especially when it forms:

- After a prolonged uptrend

- Near resistance zones

- At overbought levels (RSI above 70)

Market implications:

- Indicates loss of bullish momentum

- Suggests potential trend reversal or correction

- Encourages traders to exit long positions

- Provides opportunities for short selling or bearish strategies

When supported by high trading volume and other technical indicators, this pattern carries high reliability in predicting short-term to medium-term bearish moves.

Example:

In a typical chart example, price trends upward for several sessions. Suddenly, three consecutive bearish candles appear, each closing lower than the previous one. This visual structure helps learner sidentify how sustained selling develops over time.

(Charts are used for visual learning and illustration only.)

Where Analysts Commonly Observe This Pattern

From a technical learning perspective, the Three Black Crows Candlestick Pattern is often studied when it appears:

- Near historical resistance levels

- After extended bullish rallies

- When momentum indicators show overbought conditions

- Near long-term moving averages

These contextual factors help learners evaluate the strength of the pattern.

Comparison: Three Black Crows vs Similar Bearish Patterns

Candlestick patterns can look similar, which is why comparison is essential for learning

Three Black Crows vs Bearish Engulfing Pattern

| Feature | Three Black Crows Candlestick | Bearish Engulfing |

| Candles | 3 bearish | 2 (bullish + bearish) |

| Sentiment | Gradual shift | Suddenshift |

| Selling pressure | Sustained | Immediate |

| Educational clarity | High | Medium |

Explanation:

The Three Black Crows pattern is stronger for educational analysis since it demonstrates continuous selling over several sessions, whereas the Bearish Engulfing pattern exhibits a swift shift in mood.

Three Black Crows vs Evening Star Pattern

| Feature | Three Black Crows | Evening Star |

| Candles | 3 bearish | 3 (mixed) |

| Feature | Three Black Crows | Evening Star |

| Indecision | No | Yes |

| Interpretation | Strong bearish | Loss of momentum |

Explanation:

The Evening Star includes a phase of indecision, while theThree Black Crows Candlestick Pattern shows continuous bearish conviction.

Three Black Crows vs Dark Cloud Cover

| Feature | Three Black Crows | Dark Cloud Cover |

| Candles | 3 | 2 |

| Confirmation | Built-in | Requires confirmation |

| Learning simplicity | High | Medium |

Three Black Crows vs Shooting Star

| Feature | Three BlackCrows | Shooting Star |

| Candles | 3 | 1 |

| Reliability (education) | Higher | Lower without confirmation |

Educational Interpretation of Market Behavior

It is important to understand that candlestick patterns do not predict the future. Instead, they help learners interpret past and current price behavior.

The Three Black Crows pattern is studied to understand:

- Trend exhaustion

- Momentum shifts

- Increasing selling interest

- Market sentiment changes

Role of Technical Indicators

Indicators are often used to support candlestick analysis.

RSI (Relative Strength Index) :

Overbought readings add context to bearish patterns.

Volume:

Rising volume during bearish candles suggests stronger participation.

Moving Averages Patterns:

near long-term averages gain analytical importance.

MACD:

Momentum shifts can support pattern interpretation.

Application Across Markets

- Stock market charts

- Index charts

- Forex markets

- Commodity futures

- Cryptocurrency charts

The structure remains consistent regardless of the asset class

Common Misunderstanding

1. Using the pattern without a prior uptrend

2. Assuming guaranteed outcomes

3. Ignoring market context

4. Studying the pattern in isolation

Learning technical analysis requires understanding limitations.

Advantages of the Three Black Crows Pattern

- Easy to recognize visually

- Reflects sustained bearish sentiment

- Useful for learning trend behavior

- Works across timeframes and markets

Limitations to Be Aware Of

- Not a standalone decision tool

- Can fail in strong bullish markets

- Requires confirmation

- Market conditions matter

Importance of Risk Awareness

All technical analysis learning should be paired with:

- Risk awareness

- Emotional discipline

- Capital protection principles

Conclusion

The Three Black Crows candlestick pattern is a valuable educational concept in technical analysis. It helps learners understand how selling pressure can gradually build and change market sentiment over time.

When studied responsibly and combined with broader market context, this pattern enhances chart-reading skills and analytical confidence.