Continuation Pattern

What Is a Continuation Pattern?

A continuation pattern is a chart structure that emerges during an ongoing trend and indicates that, following a temporary pause, the price is expected to continue advancing in the same direction. The market swings laterally or marginally against the main trend during a consolidation phase, as opposed to reversing the trend.The price usually breaks out and resumes the initial upward or downward movement after this pause. In trending markets, these patterns assist traders in locating high-probability transactions.

Why Do Continuation Patterns Form?

Because markets cannot move continuously in one direction without interruptions, continuation patterns emerge. A period of price equilibrium between buyers and sellers occurs as traders book profits and new players join the market.This balancing creates recognizable shapes like triangles, pennants, and flags. These patterns show a short halt where the market picks up steam before continuing in the same direction. This consolidation demonstrates a healthy trend momentum.

The Key Features of Continuation Patterns

Continuation patterns have certain common characteristics:

- A strong trend leading into the pattern

- A sideways or slightly counter-trend consolidation

- Decreasing volume during the consolidation

- A breakout with increasing volume in the trend direction

These features help traders differentiate continuation patterns from reversal patterns. The presence of a trending move before the pattern is one of the most important requirements.

Key Types of Continuation Patterns

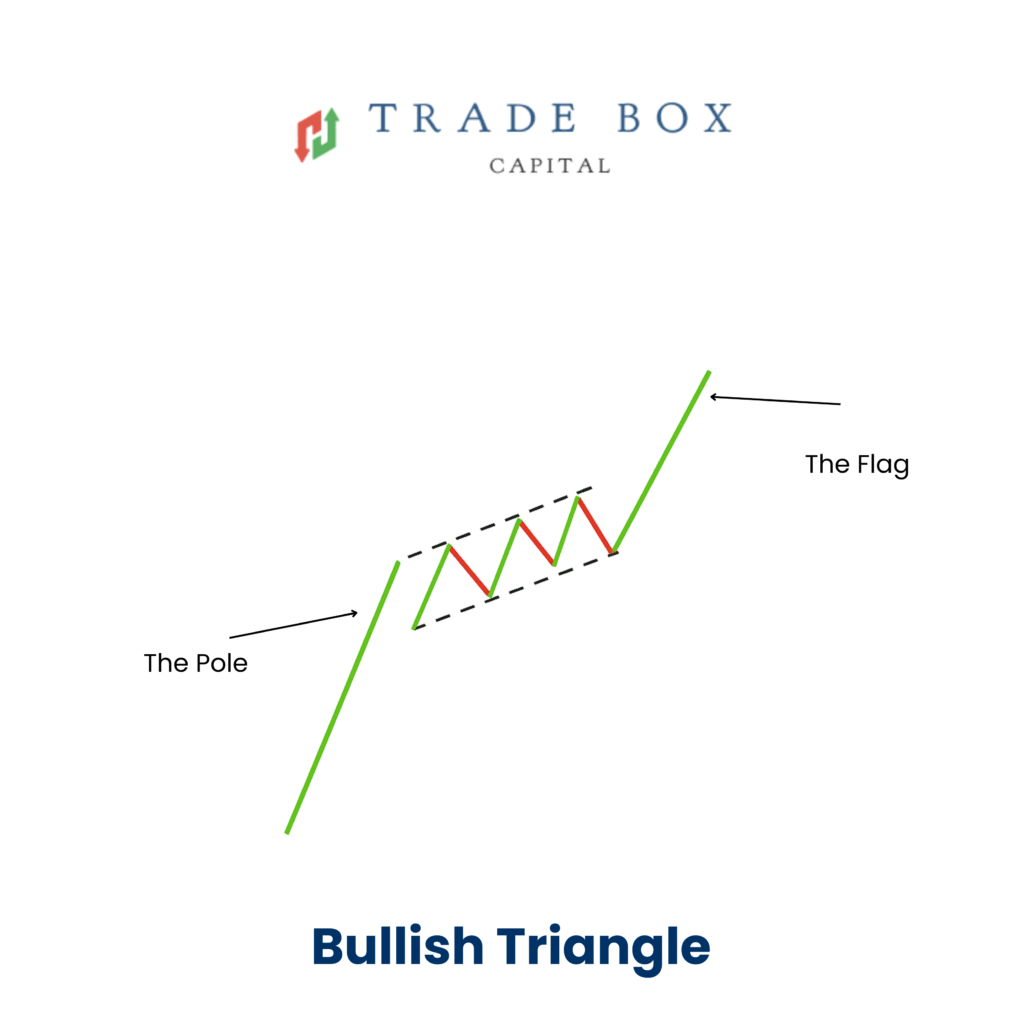

1. Flags (Bullish & Bearish)

A sharp price move followed by a small, sloping consolidation channel. Flags show a quick pause before the trend continues.

2. Pennants (Bullish & Bearish)

A small triangular pattern formed after a strong price movement. The price compresses and then breaks out in the trend direction.

5. Cup and Handle Pattern

A rounding “U-shape” (the cup) followed by a small pullback (handle). A breakout above the handle signals continuation of an uptrend.

How to Trade Continuation Patterns Effectively

To trade continuation patterns successfully, traders must understand the breakout logic.

Steps to trade:

1.Identify the Existing Trend

Verifying the current market trend is always the first step in trading continuation patterns. Only when these patterns emerge during a significant rally or downtrend are they trustworthy. Prices should exhibit higher highs and lows during an uptrend and lower highs and lows during a downturn. Instead of speculating about market reversals, recognizing the trend guarantees that you trade in the direction of momentum.

2.Wait for the Consolidation Phase

Naturally, the market pauses after a significant price shift. Consolidation is the term for this resting phase, which serves as the foundation for all continuing patterns. The price may move sideways or slightly retrace during this phase, forming triangles, rectangles, flags, or pennants. Before the next breakout, there is a brief equilibrium between buyers and sellers during this phase.

3. Mark the Breakout Levels

Finding significant breakout levels is the next stage when a distinct pattern has emerged. When the market is prepared to resume the trend, these levels serve as trigger zones.For example, the higher boundary of a flag or triangle in an uptrend indicates probable continuation, whereas the lower limit does the same in a downturn.Marking these levels allows traders to prepare for entry with precision.

4.Enter Only After Breakout Confirmation

Patience is required while trading continuation patterns. Rather than entering during consolidation, traders should wait for the price to break out and close strongly outside of the pattern. A strong breakout candle, sometimes accompanied by greater volume, indicates that momentum is returning in the direction of the trend. This strategy helps traders avoid false breakouts and increases overall accuracy.

5. Place a Logical Stop-Loss

An essential component of trading continuation patterns is risk management. Traders should place a stop-loss outside of the consolidation zone after entering. The stop-loss is usually positioned above the pattern in a downtrend and below it in an uptrend. In the event that the breakout fails and the price returns to the pattern, this guarantees protection.

6. Use Pattern Height to Set Price Targets

Continuation patterns frequently offer quantifiable goals that aid traders in more efficiently planning exits. To estimate the anticipated price change, for instance, the height of a triangle, rectangle, or flagpole can be projected from the breakout point. This approach makes trade management simpler and more reliable by setting goals that are emotionless and realistic.

Psychology Behind Continuation Patterns

The continuous struggle between buyers and sellers is reflected in these patterns. Following a forceful directional move:

- Traders book partial profits.

- New traders hesitate to enter immediately.

- Market pauses and forms consolidation

When fresh buying (in an uptrend) or selling (in a downtrend) pressure returns, the price breaks out.This psychology explains why continuation patterns are reliable since they reflect traders’ typical conduct in trending markets.

Common Mistakes Traders Make with Continuation Patterns

Even though continuation patterns are powerful, many traders misuse them.

Common mistakes include:

- Entering before the breakout

- Misidentifying reversal patterns as continuation patterns

- Ignoring volume confirmation

- Trading against the primary trend

- Setting stop-loss too tight

Traders can greatly increase pattern accuracy and overall success by avoiding these mistakes.

Advantages&Disadvantages of Continuation Patterns

Advantages | Disadvantages |

High Probability Signals – Trends usually continue longer than they reverse | False Breakouts Can Occur – Especially during volatile markets |

Clear Entry & Exit Points – Breakout and targets are easy to mark | Not Effective in Sideways Markets – Works best only in trending conditions |

Works in Any Timeframe – Intraday, swing, positional | Requires Patience – Must wait for breakout confirmation |

Easy to Identify – Visually simple patterns for beginners | Volume Confirmation Needed – Weak volume reduces reliability |

Strong Risk-to-Reward Ratio – Tight stop-loss due to consolidation zone | Misidentification Is Common – Beginners confuse them with reversal patterns |

Conclusion

Any trader who wants to confidently ride trends has to know how to use continuation patterns. They indicate when the price is prepared to move again and offer a clear understanding of market pauses. By understanding their structure, psychology, advantages, and disadvantages, traders can improve their accuracy and make better decisions. Whether you are an intraday trader or a long-term investor, knowing continuation patterns gives you an advantage in moving markets.

Frequently Asked Questions

1. What are continuation patterns in technical analysis?

Continuation patterns indicate that the existing market trend (uptrend or downtrend) is likely to continue after a brief consolidation phase. They help traders enter trades with the trend.

2. Why are continuation patterns important for traders?

They provide high-probability trade setups by confirming that buyers or sellers are still in control, reducing the risk of entering against the trend.

3. Which continuation patterns are most commonly used?

The most popular continuation patterns include:

Flag(bullish & bearish)

Pennant(bullish & bearish)

Ascending Triangle

Descending Triangle

Symmetrical Triangle

cup and Handle

4. How do you confirm a continuation pattern before entering a trade?

Traders typically look for:

Breakout from consolidation

Strong volume during breakout

Trendline break

Retest of breakout zone for safer entries

5. Do continuation patterns work in all market conditions?

No. They work best in strong trending markets. In sideways or volatile markets, continuation patterns may give false breakouts, so confirmation and risk management are essential.

What Is a Bullish Flag Pattern?

It indicates that the price pauses briefly before rising further following a significant upward advance. This pattern is used by traders to enter breakout trades using target levels, stop-losses, and clear entry.

Components of the Bullish Flag Pattern

1. The Flagpole

The flagpole symbolizes the first powerful, sharp upward movement that establishes the pattern’s framework. Usually, this increase is created by a series of bullish candles that demonstrate the buyers’ obvious supremacy. Strong momentum, heightened trading activity, and aggressive purchasing demand from institutional and retail traders are all signs of this. One of the most crucial aspects of the pattern is the flagpole’s height, which also aids traders in determining possible profit objectives following the breakout.

2. The Flag

The flag serves as a quick consolidation or resting phase and forms right after the powerful rally. At this point, the price moves in a tiny, sideways or downward-sloping channel that resembles a little parallel channel or rectangle.This consolidation results from early buyers booking profits as new traders wait for a better entry. Volume typically decreases at this point, suggesting that sellers are not strong enough to significantly cut the price. This controlled pause shows that the uptrend is still in place, and the market is only preparing for the next move.

3. Breakout

When the price closes above the flag’s upper boundary, a breakout takes place, indicating that the consolidation has ended and the uptrend has resumed. Volume typically increases at this point, indicating new purchasing interest and high market member conviction. The breakout shows that buyers have taken back control and the price is prepared to carry on its prior upward trend. At this breakout phase, traders frequently enter and set their goals based on the flagpole length.

Market Psychology Behind the Pattern

1. Strong Buying Pressure

The price rises fast as a result of a surge of aggressive buying, creating the flagpole. Strong market confidence, strong demand, and the obvious dominance of bulls are all reflected in this rally.

2. Controlled Profit Booking

Some traders book profits following the gain, which results in a slight decline or sideways movement. The flag structure is so produced. The limited and regulated selling indicates that the majority of participants are still optimistic.

3. Weak Attempts by Sellers

Sellers attempt to cut the price, but the adjustment is only modest. Their failure to produce a significant decline demonstrates that there is no bearish pressure and that the general uptrend is still going strong.

4. Breakout

Sellers attempt to cut the price, but the adjustment is only modest. Their failure to produce a significant decline demonstrates that there is no bearish pressure and that the general uptrend is still going strong. Simultaneously, short sellers pull out of their bets, fueling the rising trend and causing it to continue.

How to Identify a Bullish Flag Pattern

Step 1: Look for a Strong Uptrend

First, identify a distinct and strong increasing trend in the price. This should be made up of successive bullish candles that confirm strong purchasing momentum and form the flagpole.

Step 2: Identify Short Consolidation

First, identify a distinct and strong increasing trend in the price. This should be made up of successive bullish candles that confirm strong purchasing momentum and form the flagpole.

Step 3: Draw Trendlines

To link the consolidation area’s highs and lows, use trendlines. This makes the flag shape and makes the breakout levels easier to see.

Step 4: Wait for Breakout

When the price breaks and closes above the flag’s upper trendline, it is a legitimate bullish flag. This indicates that the upward trend will continue.

Step 5: Confirm With Volume

Make sure the breakout occurs at a higher volume. Increased traffic validates the pattern’s dependability and shows robust buyer participation.

Trading Strategy for Bullish Flag

Entry Point

You can only enter the trade when a strong breakout candle closes over the upper boundary of the flag. This suggests that the increasing trend will persist.

Stop-Loss Placement

To keep risk under control, place your stop-loss just below the flag’s lower trendline or below the most recent swing low.

Target Setting

Calculate the target by adding the flagpole height to the breakout level:

Target = Breakout Level + Flagpole Length

This simple method provides reliable and consistent profit targets.

Common Mistakes Traders Should Avoid

Mistake 1: Entering Before Breakout

- Many traders jump in during the consolidation phase.

- Enter only after a confirmed breakoutwith a proper candle close.

- Avoid predicting breakouts—trade the confirmation, not the guess.

Mistake 2: Misinterpreting Pullbacks as Flags

- Not every pullback is a valid flag pattern.

- A genuine flag must be:

- Short in duration(quick correction)

- Controlledwithout sharp opposite moves

- Formed inside a clean parallel channel

If it’s messy or wide, it’s not a flag.

Key Points About the Bullish Flag Pattern

Bullish flag forms only in a strong uptrend

Before the consolidation starts, there must be a distinct upward movement (flagpole).

Consolidation should be short, tight, and controlled

The price should fluctuate inside a narrow parallel channel devoid of volatility or abrupt spikes.

Breakout must be confirmed with strong volume

A valid breakout requires a noticeable increase in volume, showing buyer strength and follow-through.

Target = Length of the flagpole added to the breakout point

To determine your profit target, measure the first sharp move (flagpole) and project it higher from the breakout area.

Suitable for intraday, swing, and positional trading

Because it indicates momentum continuation, the bullish flag is useful on all periods.

Retest after breakout improves entry accuracy

A safer and more dependable entry opportunity is provided by the retest of the breakout level provided by many flags.

Stop-loss goes below the consolidation zone

In the event that the breakout fails and the price returns to the flag, this safeguards your trade.

Best results come in high momentum markets

During news-driven rallies or periods of strong trends, flag patterns perform remarkably well.

Conclusion

The bullish flag is a reliable continuation pattern that shows strong upward momentum. With its clear flagpole, short consolidation, and breakout, it helps traders identify high-probability buying opportunities. It becomes one of the best configurations for reliable trading outcomes when it is backed by volume and appropriate risk management.

Frequently Asked Questions

1. What is a Bullish Flag Pattern?

A Bullish Flag is a continuation pattern that forms after a sharp upward price move (flagpole), followed by a small downward or sideways consolidation that looks like a flag. It signals the uptrend will likely continue.

2. How do traders confirm a Bullish Flag breakout?

Confirmation typically occurs when price breaks above the flag’s resistance trendline with strong volume. High volume gives reliability to the breakout.

3. What is the ideal entry point in a Bullish Flag Pattern?

The most common entry is:

At the breakout above the flag’s upper trendline

Or on a retest of the breakout level for safer entries

4. How is the target price calculated in a Bullish Flag?

Target = Height of the flagpole added to the breakout point.

This gives an estimate of how far the price may move after the breakout.

5. Does a Bullish Flag always lead to an uptrend continuation?

No. False breakouts can occur if volume is low or the market is choppy. Risk management, stop-loss placement, and confirmation are essential for reliability.

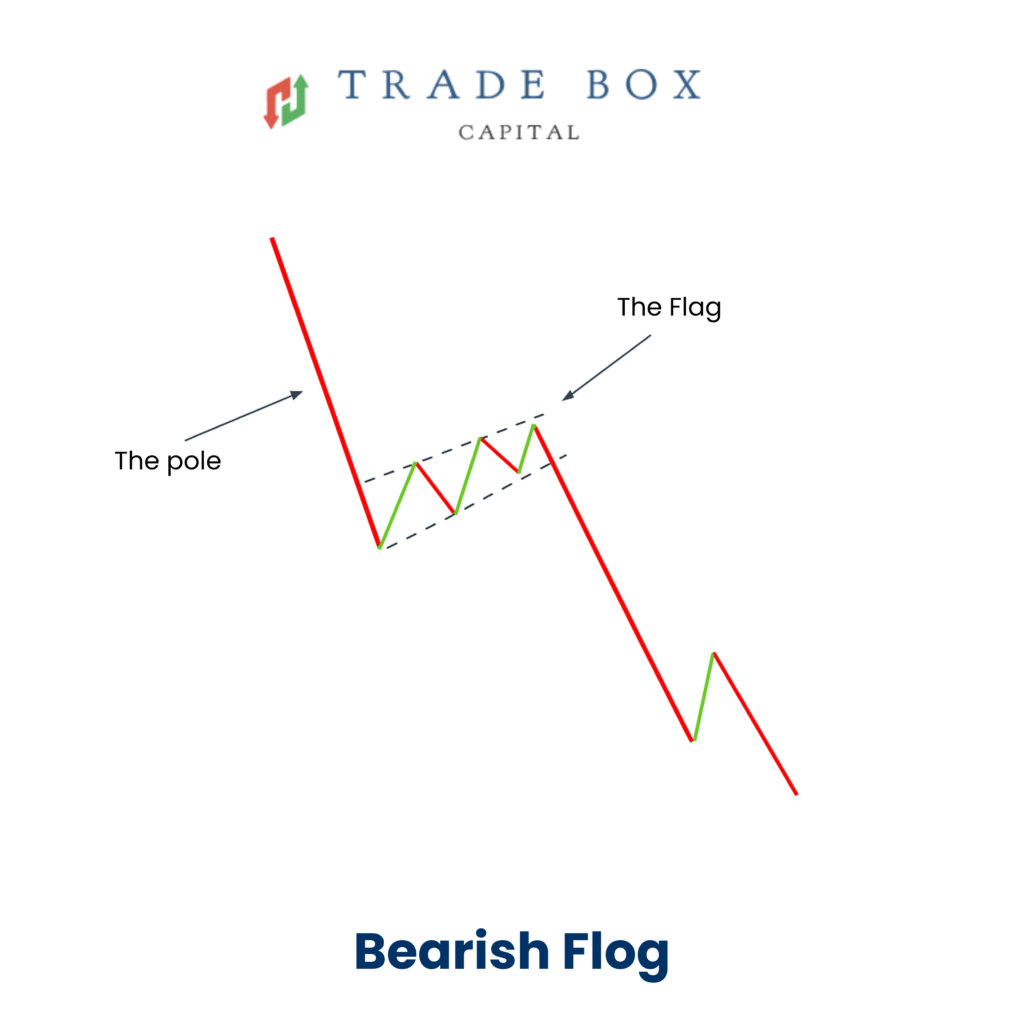

Bearish Flag Pattern

One of the most effective trend continuation patterns that traders use to determine whether a significant downtrend will continue is the Bearish Flag pattern.It develops following a steep decline in price, a brief period of stabilization, and a breakdown that rekindles the initial bearish momentum.Intraday, swing, and positional traders frequently use the bearish flag because to its unambiguous structure and consistency.

What Is a Bearish Flag Pattern?

A Bearish Flag is a continuation chart pattern that appears in a downtrend

It consists of:

- A sharp downward move→ called the flagpole

- A small upward or sideways consolidation→ called the flag

- A breakdown below the consolidation→ continuation of the downtrend

This pattern signals that sellers are still in control and the market is preparing for another leg down.

Structure of a Bearish Flag

1. Flagpole (Strong Down Move)

Long red candles and high volume indicate the pattern’s initial rapid and abrupt decline. This significant decline establishes the tone for the downward trend and demonstrates intense selling pressure. A strong, spotless flagpole shows that sellers are in complete control.

2. Flag (Consolidation Phase)

Prices usually move in a narrow, sideways, or slightly higher pattern during a brief consolidation after the major collapse. During this phase, a momentary standstill rather than a reversal is indicated by smaller candles and a lower volume. The pullback must remain shallow in order to preserve the pattern’s validity.

3.Breakdown (Continuation Move)

Enter the trade only after the price breaks below the lower trendline of the flag and gives a proper candle close. Only enter the trade when the price falls below the flag’s lower trendline and produces a suitable candle close.

Market Psychology Behind a Bearish Flag

Phase 1: Panic Selling

When the price falls below the flag’s lower trendline with a powerful red candle and heavy volume, the pattern is complete. As sellers regain complete control, this validates new selling pressure and indicates that the decline will continue.As traders scramble to sell their positions and sellers seize complete control, this produces the flagpole. Panic and a lack of buyer support are reflected in the sharp downward velocity.

Phase 2: Temporary Pause

The market goes through a brief pause or recovery phase following the sharp decline. This occurs due to:

- Some traders book profits after the big drop

- Buyers attempt a small bounce

- Sellers momentarily hold back to reassess

The flag is the result of this tight consolidation. The market is taking a break rather than reversing, as shown by the small candles and decreased volume.

Phase 3: Downtrend Resumes

The price breaks below the consolidation zone as sellers regain strength. This breakdown indicates that the initial downward trend is continuing and that the little halt has ended. The market undergoes yet another significant decline as new sellers enter the market, buyers are kept out, and momentum builds.

How to Identify a Bearish Flag Pattern

Market must be in a clear downtrend

Only when the general trend is already declining does the bearish flag become effective. This guarantees that the pattern is developing in the direction of the dominant momentum.

A steep and powerful drop should form the flagpole

The price should drop sharply and quickly before the flag shows. This dramatic decline establishes the pattern and demonstrates strong selling pressure.

Consolidation should be small and corrective

The price should have a brief respite following the significant decline. This pullback needs to be managed, shallow, and not suggest a reversal. It just indicates that the market is resting.

The consolidation must form a tight channel or parallel range

The price typically moves inside a tiny upward or horizontal channel during this pause. The flag shape is formed by the candles’ continued tiny size and restricted mobility.

Breakdown with volume confirms the pattern

Only when the price breaks below the flag’s lower trendline with more volume does the bearish flag become verified. This collapse indicates that the decline will continue and that there will be further selling pressure.

How to Trade the Bearish Flag Pattern

1. Entry Point

Only when the price breaks below the flag’s lower trendline with more volume does the bearish flag become verified. This collapse indicates that the decline will continue and that there will be further selling pressure.

2. Stop-Loss Placement

Set your stop-loss above the most recent swing high within the consolidation zone or above the flag’s upper trendline. This safeguards your trade in the event that the pattern fails or the market reverses.

3. Target Setting

Determine the objective by projecting the flagpole’s height downward from the breakout level. This provides a practical and pattern-based goal for the subsequent downward trend wave.

4. Volume Confirmation

Always check that the breakdown is accompanied by strong or rising volume, which confirms active selling pressure. A low-volume breakdown often results in weak continuation or a failed pattern.

Common Mistakes Traders Make

1.Misidentifying the consolidation zone

Many traders confuse a wide sideways trend or a severe decline for a flag. A small, tight, corrective consolidation is necessary for a bearish flag to be legitimate. The pattern becomes unreliable if the pullback retraces too much of the fall.

2.Entering before breakdown confirmation

False breakouts and stop-loss hits result from entering during the consolidation or before to a clear candle closing below the lower trendline. Confirmation increases the victory rate, thus patience is essential.

3.Ignoring the broader market trend

Strong downtrends or unfavorable market circumstances are ideal for bearish flags. The pattern may fail or become a reversal if the broader market or industry is positive.

4.Not validating with volume

Increasing sell volume should be indicative of a true breakdown. A fake breakdown or price bounce is more likely when there is low or flat volume, which indicates a lack of seller strength.

Tips for Trading Bearish Flags Successfully

Align with the higher timeframe trend

On longer timescales, such as an hour or a day, always look at the wider trend structure. When the whole market is already heading lower, bearish flags are most effective.

Wait for a confirmed breakdown

Avoid going inside the flag. Only when the price breaks and closes below the lower trendline with momentum does a trade become legitimate.

Use moving averages for confidence

The 20 EMA is one tool that helps verify the strength of the trend. The bearish setup is more robust if the price remains below the EMA throughout consolidation.

Conclusion

A strong continuation pattern that aids traders in spotting possible declines following a brief consolidation is the bearish flag pattern. It becomes a trustworthy instrument for both novice and expert traders when it is well understood, including its structure, psychology, and trading regulations.By waiting for a clean breakout and using disciplined stop-loss and target rules, you can greatly improve your trading accuracy during downtrends

Frequently Asked Questions

1. What is a Bearish Flag Pattern?

A bearish flag is a continuation pattern where the price drops sharply (flagpole), then moves sideways or slightly upward (flag), before continuing the downtrend.

2. How can I identify a Bearish Flag?

Look for:

A strong downward move

A small upward/sideways channel

Breakout below the channel with volume

3. What does a Bearish Flag Pattern indicate?

It signals that sellers are still strong and the price is likely to continue falling after a short consolidation.

4. Where should traders usually enter the trade?

Entry is typically taken when the price breaks below the lower trendline of the flag with good volume.

5. What is the target for a Bearish Flag Pattern?

The target is usually the length of the flagpole projected downward from the breakout point.

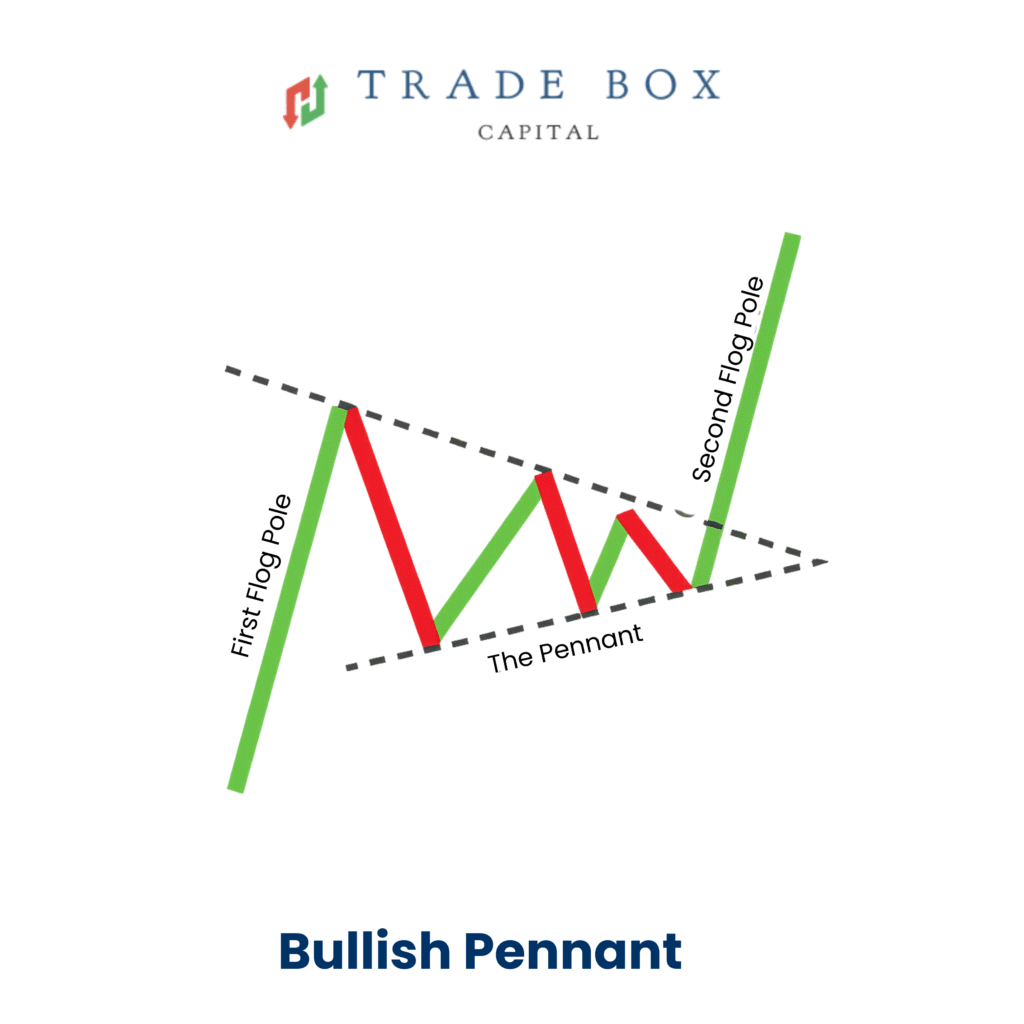

Bullish Pennant Pattern

One of the most potent continuation patterns in technical analysis is the bullish pennant. It shows that the price is getting ready for another bullish breakout and appears during significant uptrends. Because of its outstanding reliability and obvious structure, traders use it on intraday, swing, and positional timeframes.

The structure, formation, psychology, identification rules, strategy, confirmation signals, stop-loss/target rules, pitfalls to avoid, and expert advice are all covered in this guide.

What Is a Bullish Pennant Pattern?

A bullish pennant is a continuation pattern that follows a notable upward price increase (also called the flagpole). Following this hasty move, the price enters a brief consolidation that narrows into a little symmetric triangular shape.After this pause, the price breaks out upward, continuing the original uptrend.

Key elements:

1. Strong Flagpole (Sharp Upward Move)

This is the first significant bullish push, during which the price rises quickly. It establishes the pattern’s basis and demonstrates significant buying pressure.

2. Small Triangular Consolidation (Pennant)

Following the steep increase, the price stops and forms a little triangle by moving between two converging trendlines. There is a little profit-booking but no reversal of the trend.

3. Breakout in the Direction of the Trend

The price breaks above the top trendline when buyers reclaim control after consolidation is over. The uptrend’s continuation is confirmed by this breakout.

4. Volume Confirmation

Volume rises during a breakout and falls during a consolidation. Strong bullish momentum is shown by this increasing volume, which validates the breakthrough.

How the Bullish Pennant Forms

There are three main stages in the development of the Bullish Pennant pattern, each of which represents a distinct period of market behavior:

1. Flagpole Formation

Strong buying pressure causes the price to climb quickly and sharply at the start of this phase. The pennant pattern is established and bullish superiority is shown by the swift upward rise.

2. Pennant Consolidation

Although momentum slows during this halt, sellers are still unable to drive the price lower, suggesting that the underlying uptrend is still robust.

3. Breakout Phase

The price breaks above the top trendline when buyers reclaim control after consolidation is over.This breakout, which is frequently accompanied by increased volume, indicates that the uptrend will continue and that the Bullish Pennant pattern has been completed.

Market Psychology Behind the Pattern

Understanding market psychology helps traders trust the pattern:

Buyers push the price sharply upward → Flagpole

Short-term traders book profits → Price enters consolidation

Sellers attempt to push price down → But fail due to strong demand

Buyers step in again with confidence → Upward breakout

Momentum continues → Trend resumes

This shows that the bullish sentiment remains intact despite a temporary pause.

How to Identify a Bullish Pennant

A few key technical aspects must be examined in order to spot a bullish pennant. Verify the validity of the pattern using the following checklist:

Strong Uptrend Required

The pattern must appear within a clear bullish trend. Without an existing uptrend, the pennant loses its reliability.

Sharp Flagpole

A rapid and strong upward price movement should precede the pennant. This flagpole shows aggressive buying and sets the stage for the continuation pattern.

Converging Trendlines

During consolidation, the price should move within two converging trendlines, creating a small symmetrical triangle. If the lines are parallel, it is not a pennant but a flag.

Volume Declines During Consolidation

Volume should gradually decrease as the pennant forms. This signals a healthy pause in momentum rather than a reversal.

Short Duration

Pennants form quickly, making timing essential.

- Intraday: 15–60 minutes

- Swing Trading: 3–10 trading days

Shorter duration indicates a strong continuation of momentum.

How to Trade the Bullish Pennant Pattern

Trading the Bullish Pennant effectively requires patience, confirmation, and proper risk management. Follow this step-by-step strategy to execute the pattern with confidence:

1. Wait for the Breakout

Never enter a trade while the price is still inside the pennant.A valid entry happens only when the price closes above the upper trendline, confirming that buyers have regained control.

2. Buy Entry

Enter the trade once the breakout is clear. Buying opportunities include:

- When the price breaks above the pennant with strong momentum, or

- When the price retests the breakout level and forms a bullish candle, confirming support.

3. Stop-Loss Placement

Put a stop-loss at a secure area to safeguard your position:Below the lower trendline, orSlightly below the consolidation areaThis helps you avoid losses from false breakouts or sudden volatility.

4. Profit Target

Use the height of the flagpole to set your target. The formula is:

Target = Breakout Level + Flagpole Height

Example:

Flagpole Height: 50 points

Breakout Level: 200

Target = 250

This method provides a logical, measurable price objective based on the pattern structure.

Common Mistakes Traders Make

While the Bullish Pennant is a reliable continuation pattern, traders often make errors that reduce its effectiveness. Avoiding these mistakes can significantly improve your success rate.

Misidentifying the Pattern

Many traders confuse pennants with other formations. If the trendlines are not converging or if there is no clear flagpole, it is not a valid Bullish Pennant.

Entering Before Breakout

Entering too early—while the price is still consolidating—can lead to false entries. Always wait for a confirmed breakout above the upper trendline.

Ignoring Volume Behavior

Volume should drop during consolidation and rise sharply during the breakout. A breakout without increased volume often leads to failure.

Placing Stop-Loss Too Tight

Pennants can have small wicks or volatility during consolidation. A tight stop-loss may cause premature exits. Place it below the consolidation zone for safety.

Trading During Major News Events

High volatility during news releases can distort patterns and trigger false breakouts. Avoid taking trades around major economic announcements.

Tips for Trading Bullish Pennants

To increase your accuracy and improve trade outcomes, apply these expert-level tips while trading Bullish Pennants:

Combine with Indicators Like 20 EMA, RSI, or MACD

Using supportive indicators enhances confirmation.

- The 20 EMA helps identify momentum.

- RSI can show strength in buying pressure.

- MACD helps confirm trend continuation.

Together, they make your entry more reliable.

Prefer Breakouts with 2× Average Volume

A significant increase in volume should accompany a robust breakthrough. Buyer strength is confirmed and the chance of a breakout failure is decreased when the breakout volume is at least twice the average.

Avoid Trading the Pattern During Major Macro News

Important economic announcements can cause sudden volatility. News events often lead to fake breakouts that invalidate technical patterns. Wait for stable market conditions before entering.

Always Use a Positive Risk–Reward Ratio (1:2 or Higher)

Even a few profitable trades can provide steady earnings if the risk-reward ratio is strong. Aim for at least 1:2, which means that two units of return are targeted for every unit of risk.

Conclusion

A dependable continuation pattern that aids traders in identifying powerful momentum-based breakouts is the Bullish Pennant.It becomes a useful instrument for seizing the following leg of an upswing with appropriate volume confirmation, a clear breakout, and disciplined risk management.

Frequently Asked Questions

1. What is a Bullish Pennant Pattern?

A Bullish Pennant is a continuation pattern that forms after a strong upward move, followed by a small consolidation shaped like a triangle. It signals that the uptrend is likely to continue after a breakout.

2. How do I identify a Bullish Pennant?

Look for a sharp price rally (flagpole), then a tight consolidation between converging trendlines, and finally a breakout above the upper trendline with volume.

3. What confirms a Bullish Pennant breakout?

A valid breakout happens when the price closes above the resistance line with strong volume, showing renewed buying pressure.

4. Where should traders place the target?

The most common method is to measure the height of the flagpole and add it to the breakout level to estimate the next price target.

5. Is the Bullish Pennant Pattern always reliable?

No pattern is 100% accurate. False breakouts can occur, so traders use stop-loss orders and confirm the breakout with volume and trend strength.

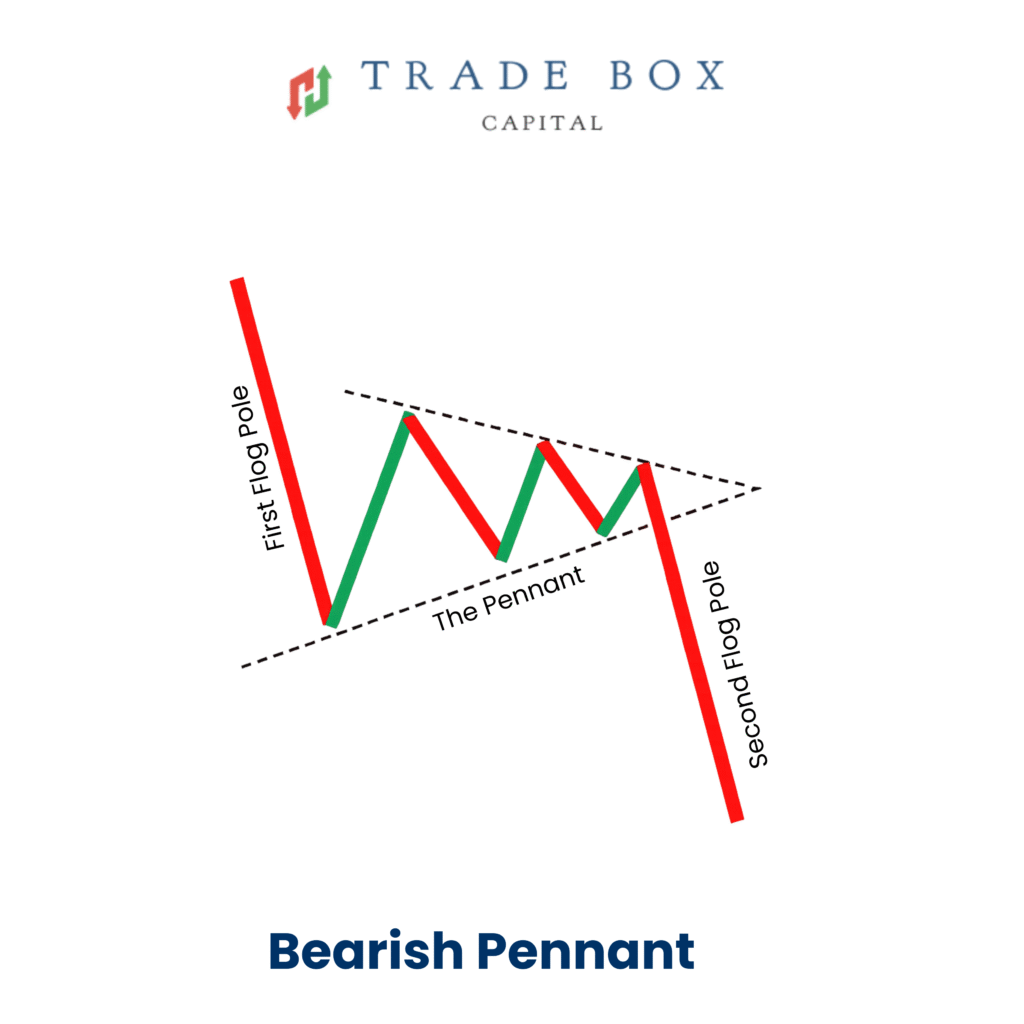

Bearish Pennant Pattern

The bearish pennant is a powerful continuation pattern that appears during strong downtrends. It indicates that the price is expected to continue declining quickly following a brief consolidation. Because of this, intraday, swing, and positional traders who seek out high-probability shorting chances love it.

Key Components

1. Steep Downward Move (Flagpole)

The pattern begins with a sharp and powerful decline created by strong selling pressure. This long red move sets the direction and forms the flagpole, indicating that bears are in full control.

2. Small Triangular Consolidation (Pennant)

After the big drop, the price enters a short consolidation phase. During this stage, the highs get lower and the lows get higher, forming a small, tightening triangle. This shows that the market is temporarily pausing but not reversing.

3. Declining Volume During Consolidation

Volume typically drops as the pennant forms. This reduction signals that both buyers and sellers are waiting, and the market is in a temporary equilibrium before the next major move.

4. Breakdown With Strong Volume

A bearish pennant is only validated when the price breaks below the lower trendline and there is a noticeable increase in volume. This breakthrough, which suggests new selling pressure, has caused the decline to continue.

Structure of a Bearish Pennant

1. The Flagpole

The pattern starts with an aggressive and powerful selloff that results in a sharp decline. This steep drop indicates strong negative momentum and establishes the pattern’s direction.

2. The Pennant

After the sharp drop, there is a brief period of price consolidation. You can move around in this little, symmetrical triangle.

- Highs keep getting lower

- Lows keep getting higher

This tightening structure shows a temporary pause in the trend as the market contracts before the next big move.

3. The Breakdown

When a powerful bearish candle breaks below the pennant’s lower trendline, the pattern is finished. This collapse, which is typically accompanied by a jump in volume, indicates that sellers have taken back control and the decline is prepared to continue.

Market Psychology Behind Bearish Pennant

- A steep initial decline is brought on by strong selling pressure.

- There is a brief period of consolidation as buyers try to stabilize the price.

- The pennant structure is formed by the buyer’s continued weakness.

- Strong volume returns from sellers smash the support level.

- The downward trend continues as more traders join the selling.

- The trend is very dependable because sellers consistently dominate the market.

How to Trade a Bearish Pennant

1. Identify the Flagpole

Begin by spotting the strong downward move that forms the flagpole. This usually appears as a series of large red candles indicating heavy selling pressure.

2. Mark Pennant Trendlines

Draw two trendlines around the consolidation:

- A downward-sloping resistance line

- An upward-sloping support line

- These lines form the small triangular pennant.

3. Wait for Breakdown Confirmation

Avoid going in early. Only when a candle firmly closes below the pennant’s support line with more volume should a transaction be opened. This demonstrates that sellers are again in charge.

4. Place Stop-Loss

Always protect your position by placing the stop-loss:

- Above the upper trendline of the pennant

- Above the recent consolidation high

- This prevents losses from false breakouts.

5. Set Profit Targets

Calculate the target using the height of the flagpole.

Target = Flagpole Height

Example:

- Flagpole size: 50 points

- Breakdown level: ₹400

- Target: ₹400 – 50 = ₹350

This method ensures consistent and reliable execution.

Volume Behavior

1. Volume Decreases During Consolidation

Volume progressively drops and trading activity slows as the pennant forms. This decline indicates that there is a little break in the market and that both buyers and sellers are waiting.The view that the consolidation is merely a brief break rather than a reversal is supported by the decreasing volume.

2. Volume Spikes During Breakdown

Volume usually increases dramatically when the price breaches below the pennant support. This increase in volume indicates that sellers have made a strong comeback and are prepared to drive the trend much lower.

3. Strong Confirmation of Pattern Validity

The Bearish Pennant is more dependable when low volume occurs during consolidation and strong volume occurs after breakdown.This volume behavior signals genuine bearish momentum and helps filter out false breakouts.

Common Mistakes Traders

1. Entering Before Breakdown

Many traders jump in too early, entering during consolidation. This often leads to false signals and unnecessary losses.

2. Misidentifying Pennant vs Triangle

A pennant is a short, tight structure formed after a sharp drop, while a triangle is larger and forms over a longer period. Confusing the two affects trade accuracy.

3. Ignoring Volume

A breakdown without strong volume is unreliable. Low volume often results in failed breakouts and price reversals.

4. Trading During News

Major news events can create unpredictable volatility, causing false breakouts that invalidate the pattern.

Trading Bearish Pennants Successfully

Use Higher Timeframe to Confirm the Downtrend

Before entering any trade, check higher timeframes like 1H or 4H to ensure the broader trend is clearly bearish. This increases accuracy and filters out weak setups.

Always Wait for a Candle Close Below Support

Avoid entering while consolidation is underway. Strong candles that close below the support of the pennant indicate genuine selling pressure and lower the possibility of phony breakouts.

Use the 20 EMA to Validate Momentum

When the price stays below the 20 EMA during formation and breakdown, it signals strong bearish momentum and supports continuation.

Maintain a Minimum Risk–Reward of 1:2

Bearish pennants provide quantifiable goals. To ensure that even a few profitable transactions surpass losses, use them to plan a risk-reward ratio of at least 1:2.

Avoid Trading in Choppy or Sideways Markets

When there is no direction in the market, pennants become unreliable. To prevent misleading signals, trade them only when there is a significant trend.

Use RSI for Additional Confirmation

The bearish strength is still present if the RSI stays below 50. This boosts confidence in the setup and makes the breakdown more reliable.

Conclusion

The Bearish Pennant is a reliable continuation pattern that helps traders capture the next phase of a downtrend. When identified correctly and confirmed with strong volume, it offers high-probability shorting opportunities. Traders can greatly increase their success rate with this pattern by combining appropriate entry rules, careful risk management, and higher-timeframe confirmation.

Frequently Asked Questions

1. What is a Bearish Pennant Pattern?

A Bearish Pennant is a continuation chart pattern that forms after a sharp downward move (flagpole), followed by a small consolidation that looks like a triangle. It signals that the downtrend is likely to continue.

2. How do I identify a Bullish Pennant?

You can spot it by:

A strong downward flagpole

A small symmetrical triangle consolidation

Lower highs and higher lows creating the pennant shape

A breakout below the support line

3. What confirms a Bearish Pennant breakout?

Confirmation happens when the price breaks below the pennant’s support with strong volume, continuing the earlier downtrend.

4. How is the target calculated in a Bearish Pennant?

The price target is estimated by measuring the length of the flagpole and subtracting that distance from the breakout point of the pennant.

5. Is a Bearish Pennant a reliable pattern?

Yes, it is considered reliable because it appears during strong downtrends. However, traders should wait for a clear breakout and volume confirmation to avoid false signals.

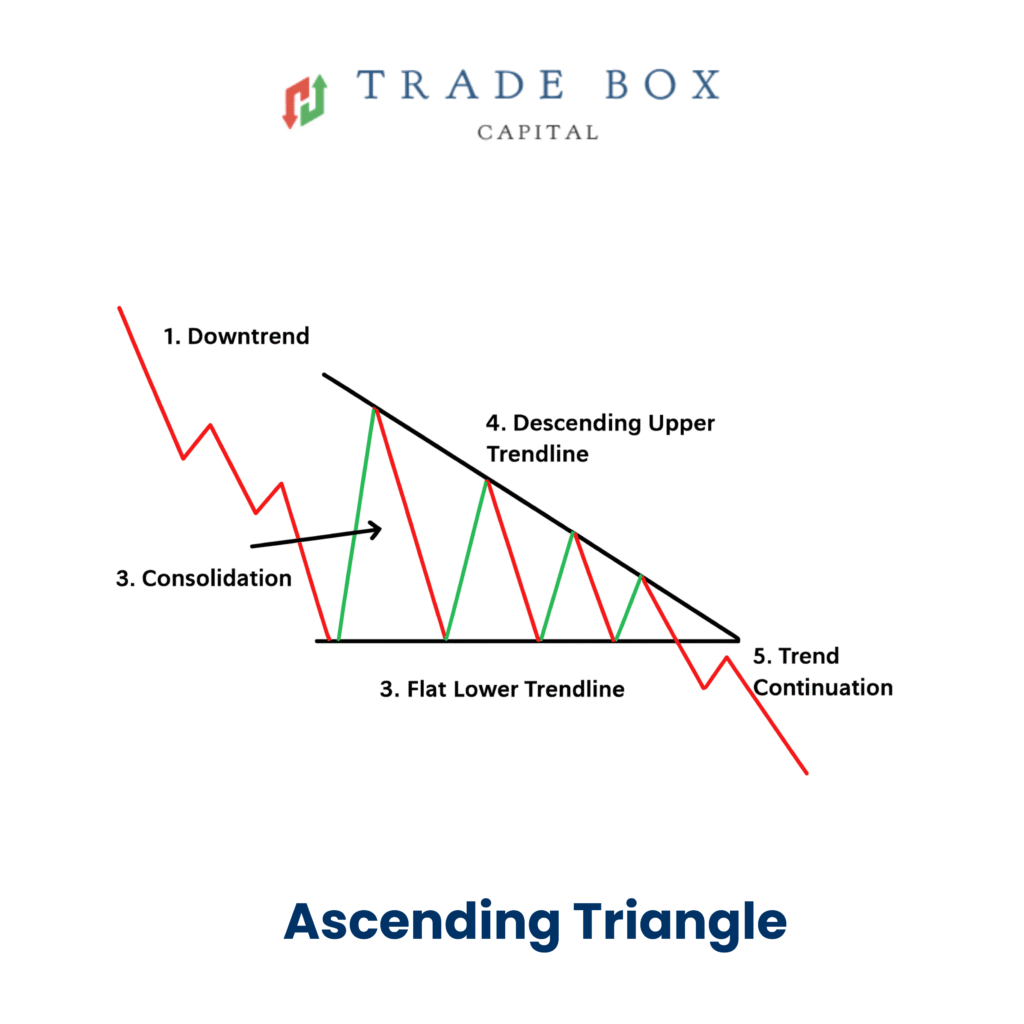

Ascending Triangle

The Ascending Triangle is one of the most powerful bullish continuation patterns in technical analysis. It shows how buyers are gradually surpassing sellers, creating the conditions for a market breakthrough.

What Is an Ascending Triangle?

An Ascending Triangle is a bullish continuation pattern where the price repeatedly hits a horizontal resistance while forming higher lows on the downside.

This shows increasing buying pressure as buyers step in at higher prices with each downturn.There is often a strong upward breakout supported by growing momentum when the resistance finally gives way.

Structure of the Ascending Triangle

1.Horizontal Resistance Line

- A strong ceiling where price repeatedly fails to break above.

- Multiple touches confirm that sellers are active at the same level, creating a clear breakout zone.

Rising Support (Higher Lows)

- The support trendline slopes upward as buyers step in at higher prices each time.

- It shows growing bullish strength and consistent demand pushing the market upward.

Tightening Price Action

- Price movement narrows as rising support pushes into fixed resistance.

- This squeeze builds pressure, making an upside breakout increasingly probable.

Market Psychology Behind the Ascending Triangle

Understanding the psychology helps traders trust the pattern:

Sellers defend the resistance zone repeatedly.

But buyers keep stepping in at higher lows → demand increasing.

Each higher low shows that buyers are gaining strength.

Eventually sellers weaken → big breakout happens.

Breakout often comes with high volume, showing aggressive buyer participation.

How to Identify an Ascending Triangle

Existing Uptrend

The Ascending Triangle works best when it forms in an already rising market. It shows the trend is pausing before continuing upward.

Multiple Touches on Resistance & Support

Price should hit the top resistance level multiple times without breaking it, while the support trendline keeps rising. This confirms the pattern’s structure.

Higher Lows Indicating Buyer Strength

Each pullback ends higher than the previous one, proving that buyers are becoming more aggressive and absorbing selling pressure.

Volume Contracting During Consolidation

As the triangle develops, market activity usually slows down. This shrinking volume reflects indecision and buildup of pressure.

Volume Surge on Breakout

A strong breakout above resistance must be supported by a noticeable jump in volume, which signals genuine buying interest and reduces the chance of a false move.

Candlestick Behavior in Ascending Triangle

Bullish Engulfing

A strong bullish candle completely covers the previous bearish candle, showing buyers taking control before the breakout.

Marubozu Candle

A full-bodied candle with no wicks indicates powerful buying momentum, often appearing right before or during the breakout.

Three White Soldiers

Three consecutive bullish candles signal steady upward pressure, confirming strong buyer dominance inside the triangle.

Bullish Pin Bar

A candle with a long lower wick shows strong rejection of lower prices, indicating buyers stepping in aggressively.

Breakout Candle with Long Body

A large bullish candle closing above resistance confirms a clean breakout and reduces the chance of a false move.

Breakout Candle with Long Body

1. Breakout Entry

- Only after the price closes well above the resistance line should you enter the trade.

- Strong buyer interest is indicated by a breakout backed by large volume, which also lessens the possibility of a false move.

Retest Entry

- Wait for the price to retreat and retest the previous resistance after the breakout.

- Enter when the retest displays a bullish candlestick pattern, such as a pin bar, engulfing, or strong bullish candle.

- This offers a more reliable and safe access.

3.Stop-Loss Placement

- Place your stop-loss either below the rising support trendline or just below the most recent swing low.

- This protects you from false breakouts and sudden pullbacks.

Target Setting

To compute targets, use these two easy methods:

Measured Move

To find the target, measure the triangle’s height and add it above the breakout point.

Extensions of Fibonacci

For extended profit goals in a strong trend, use extensions of 1.272 or 1.618.

Common Mistakes Traders

Many traders fail to capitalize on the Ascending Triangle due to avoidable errors. Understanding these mistakes can improve success rates significantly.

1.Entering Before Breakout

A frequent mistake is taking a position before the price actually breaks resistance. The pattern can give false signals, and early entry often leads to losses if the breakout fails.

2.Weak Volume Breakout

A breakout without sufficient volume is unreliable. Low volume indicates a lack of buying interest, making the move prone to reversal or failure. Always look for a volume spike to confirm the breakout.

3.Misidentifying the Trend

The Ascending Triangle is a bullish continuation pattern, so entering trades in a downtrend or sideways market can backfire. Misreading the trend may turn a potential winning trade into a losing one.

4. Ignoring Retest

Many traders skip waiting for the retest of the broken resistance, which is now acting as support. Entering without confirmation increases the chances of a false breakout.

5.Overleveraging

Leverage overuse can exacerbate losses, especially if the breakout fails or there is a short fall. Conservative position sizing helps manage risk.

- Combine with Moving Averages: Use the 20 or 50 EMA to assess a trend’s strength and potential support.

- Await the Breakout Candle Close: To prevent false breakouts, enter right after a candle closes above resistance.

- Avoid large news events because they can lead to unpredictability and price volatility.

- Preserve the Risk-Reward Ratio: To ensure that potential gains outweigh potential losses, keep the ratio at least 1:2.

A Strong upward momentum is indicated by the Ascending Triangle, a bullish continuation pattern.With rigorous risk management, volume confirmation, and breakout validation, it provides high-probability trading opportunities in any market or time frame.

Frequently Asked Questions

1. What is an Ascending Triangle Pattern?

An Ascending Triangle is a bullish continuation pattern formed by a horizontal resistance line and rising higher lows, signaling strong buying prssure.

2. What does the pattern indicate?

It indicates that buyers are consistently pushing the price higher, and a breakout above resistance often leads to a strong upward move.

3. How do traders confirm the breakout?

A breakout is confirmed when the price closes above the resistance line with strong volume.

4. Where is the target price measured from?

The target is calculated by measuring the height of the triangle (resistance minus the lowest low) and adding it to the breakout point.

5. Does the pattern ever fail?

Yes. If the price breaks down below the rising trendline instead of breaking resistance, the pattern fails and can signal a bearish move.

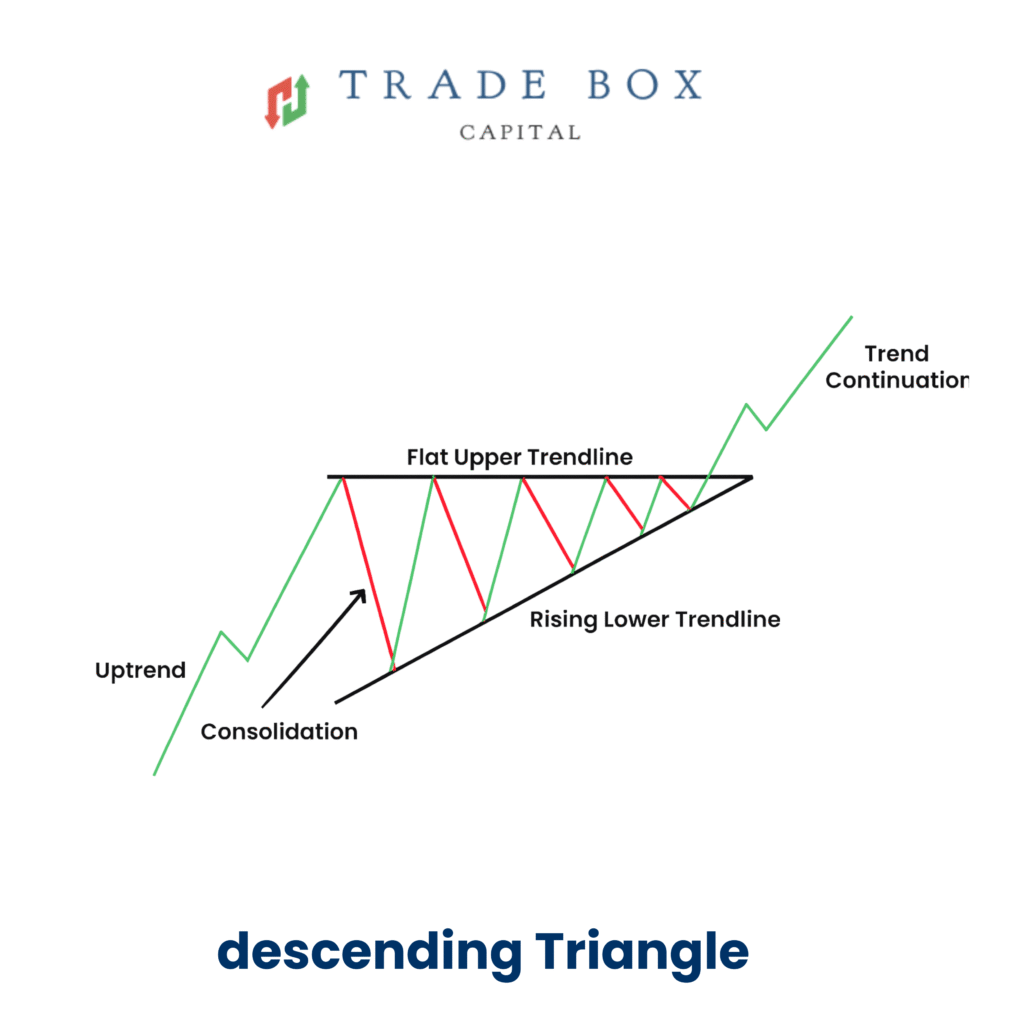

Descending Triangle Pattern

The descending triangle is one of the most popular and reliable bearish continuation chart patterns in technical analysis. It signals that sellers are becoming stronger, buyers are weakening, and a downside breakout is likely.

Knowing this pattern can help you spot high-probability short trades and predict market collapses, regardless of your level of experience.

What is a Descending Triangle?

When the price continually challenges a horizontal support level while producing a string of lower highs on the upper side, a bearish chart pattern known as a descending triangle is created. This arrangement demonstrates that buyers are attempting to maintain the support zone, but when sellers intervene earlier each time, each upward rise gets weaker. The pattern usually appears during a slump and indicates a progressive increase in selling pressure.

The price is pushed between robust selling from above and declining demand below as the triangle moves forward. The bearish trend is typically confirmed when this compression results in a breakdown below the support line.

Key Characteristics

1. Horizontal Support Line

The horizontal support line in a descending triangle serves as a solid floor where the price taps several times without breaking.This repeated testing shows that buyers are trying to defend the level, but it often weakens over time until a breakout finally occurs.

2. Downward Sloping Resistance

The upper trendline slopes downward because each new peak is lower than the previous one. This shows that sellers are frequently intervening earlier, which suggests a drop in purchasing capacity and a rise in selling pressure

3. Volume Decrease During Formation

Trading volume typically declines as the pattern progresses. This decline in volume is a reflection of lower participation and market hesitation. However, volume usually increases dramatically after the breakout, particularly below support, indicating a powerful move.

4. Bearish Bias

Because it frequently emerges in a downtrend and indicates continuation, the Descending Triangle typically bears a pessimistic view. When the pattern forms at the top, it can also function as a reversal, albeit this is uncommon, and the prevailing expectation is still negative.

How a Descending Triangle Forms

- Downtrend in Place: The pattern typically emerges when the price is already moving lower.

- Horizontal Support: The price consistently finds support close to the same level while consolidating.

- Lower Highs: At every bounce, sellers actively enter the market, resulting in steadily declining highs.

- Price compression- occurs when the price is compressed between the falling resistance and the horizontal support.

- Verification of Breakout: A strong breakout below the support line verifies the Descending Triangle.

- Retest of Broken Support: After a collapse, the price usually retests the broken support, which now acts as resistance.

- Continuation of Downtrend: Following the retest, the price typically continues to fall in line with the prevailing trend.

1. Identify the Pattern

- Make that at least two lower highs being formed by the price.

- Verify that the price makes at least two taps to the horizontal support line.

- When the price is being squeezed between the flat support and the declining resistance, look for a distinct compression structure.

- Examine the context of the trend: Descending triangles typically emerge during a decline, which increases the likelihood of a negative breakout.

- Examine volume behavior: the validity of the pattern is strengthened when volume decreases throughout development.

2. Entry Strategies

A. Breakout Entry

- When a candle closes firmly below the horizontal support, make a short trade.

- A strong bearish candle with large volume is preferred since it indicates selling pressure.

- To lower the chance of false breakouts, wait for unambiguous confirmation before entering.

B. Retest Entry (Safer Option)

- After the breakout, the price may retest the broken support, which now acts as resistance.

- Enter short if the retested level rejects price and a bearish candle forms.

- Because it prevents early admissions, this strategy provides a higher risk-to-reward ratio.

3. Stop-Loss Placement

- Set the stop-loss just above the pattern’s most recent lower peak.

- To guard against false breakouts and abrupt price surges, stops must be placed correctly.

- Alternatively, if you are using the retest entry approach, put it above the retest rejection candle.

4. Profit Targets

- The triangle’s height, expressed as follows, is the main profit target:

- Height = Support Level = Highest Lower High

- For a target price, project this height downward from the breakout point.

- You can also use it in conjunction with other technological tools for increased accuracy:

- Previous zones of support

- Fibonacci retracement levels

- Previous swing lows or consolidation zones

- Consider scaling out the transaction at many objectives to ensure rewards and manage risk.

5. Additional Tips

- Always trade in the direction of the current trend for setups with higher likelihood.

- Use volume confirmation; a large volume breakout is more reliable.

- Use momentum indicators like RSI or MACD to find dropping buys or rising sellers.

- Avoid trading when there is little liquidity because this could lead to false breakouts.

Advantages of the Descending Triangle

High Probability Setup in a Downtrend

Descending triangles provide traders with a dependable continuation pattern with significant breakout potential, and they perform particularly well during prolonged downtrends.

Easy to Identify Visually

Both novice and seasoned traders can easily identify the structure on charts because to its simplicity and clarity—lower highs meeting a horizontal support line.

Clear Support and Resistance Levels

Both novice and seasoned traders can easily identify the structure on charts because to its simplicity and clarity—lower highs meeting a horizontal support line.

Provides Measurable Breakout Targets

The height of the triangle can be used to project a realistic and effective price target, enhancing accuracy in profit planning.

Supports Multiple Entry Types

Traders can choose between a direct breakout entry or a safer retest entry, making it suitable for different trading styles.

Strong Volume Confirmation

High volume breakouts provide additional validation, lowering uncertainty and boosting trade confidence.

Works Across Timeframes

The pattern is effective on intraday, swing, and long-term charts, offering flexibility for various market participants.

Limitations of the Descending Triangle

False Breakouts Are Common

False breakdowns, in which the price momentarily falls below support before swiftly reversing, can occasionally result from descending triangles, catching traders who invested early.

Requires Volume Confirmation

Confirmation is crucial for dependable trades because the pattern may fail or move poorly in the absence of substantial volume during the breakout.

Not Always a Continuation Pattern

Although descending triangles are often bearish, they can occasionally break higher, especially in volatile or news-driven markets, yielding unexpected outcomes.

Support Zone May Be Wide

It can be more difficult to pinpoint a precise breakout point when the support level is a wider zone rather than a straight line.

Timeframe Sensitivity

Traders must carefully align their analysis because the pattern may appear apparent on one timeframe but distorted or inaccurate on another.

Market Noise Can Distort the Pattern

The structure may be disturbed by abrupt spikes, wicks, or volatile candles, making it more difficult to identify or precisely trade the pattern.

Delayed Breakouts Reduce R:R Ratio

The price target shrinks if the breakout happens too late or too near the peak, which lowers potential profit relative to risk.

Delayed Breakouts Reduce R:R Ratio

In well-established downtrends, descending triangles perform best. The breakout may be weak or untrustworthy when it forms in sideways or choppy markets.

Tips for Trading Descending Triangles

- To verify the direction of the trend, choose a longer timeframe.

- During formation, keep an eye out for a declining volume.

- Steer clear of entering before breakthrough confirmation.

- For additional accuracy, combine with RSI divergence.

- The optimum risk-reward ratio is provided by retest entries.

Conclusion

A strong bearish continuation pattern that aids traders in reliably spotting breakdown possibilities is the Descending Triangle.This pattern can greatly increase your short-trade accuracy with careful identification, volume confirmation, breakout/retest entries, and rigorous stop-loss placement.

Frequently Asked Questions

1. What is a Descending Triangle Pattern?

An Ascending Triangle is a bullish continuation pattern formed by a horizontal resistance line and rising higher lows, signaling strong buying pressure.

2. What does a Descending Triangle indicate in trading?

It usually indicates that sellers are stronger, and there is a high probability of a breakdown below the support level.

3. How do you identify a valid Descending Triangle?

A valid pattern must have:

A lower-high trendline

A flat support level touched at least 2–3 times

Price consolidation inside the triangle

Volume often decreasing as the pattern forms

4. Where should traders enter a trade in a Descending Triangle?

Traders often enter a sell position after a confirmed breakdown, meaning:

Candle closes below support

Increased volume after the breakout

5. What is the target after breakdown?

The target is typically calculated by measuring the height of the triangle (top to support) and subtracting it from the breakout point.

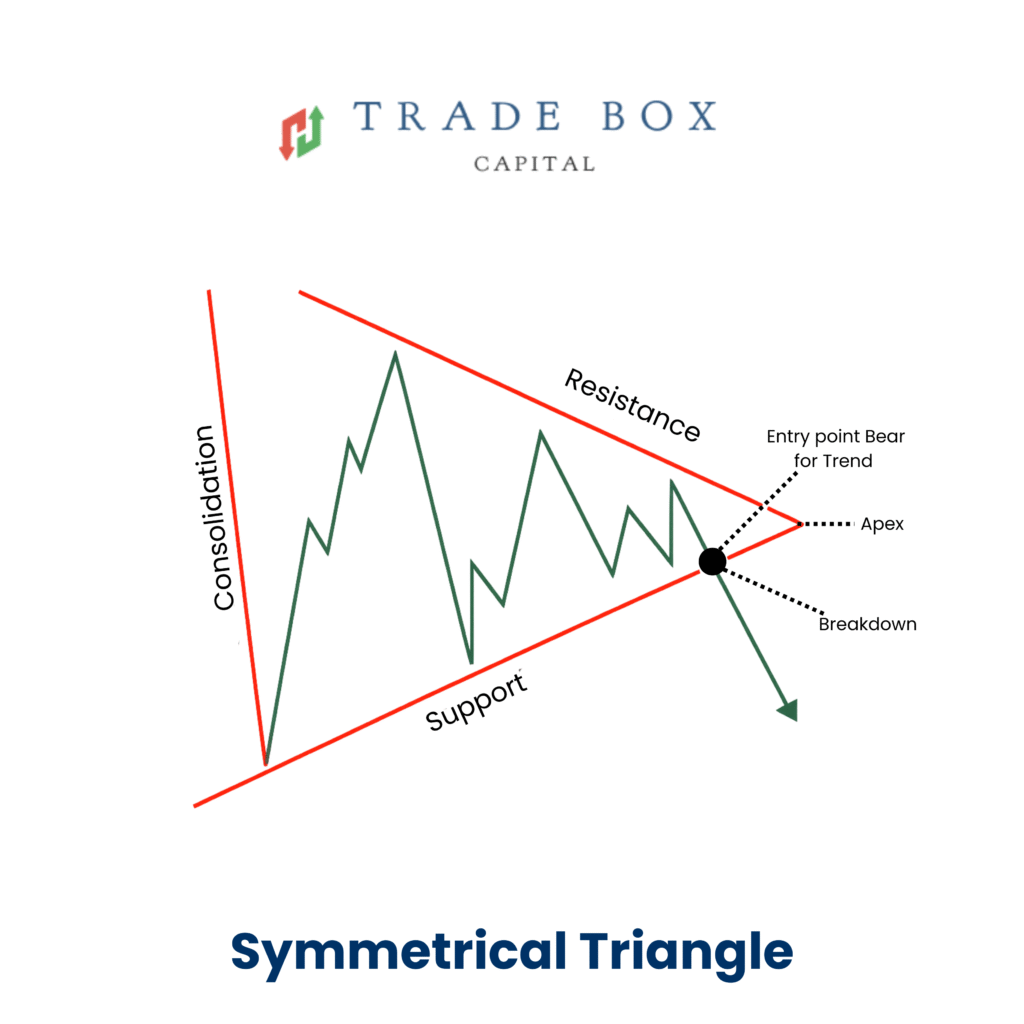

Symmetrical Triangle

The market enters a compression phase during this consolidation period, during which price action tightens and volatility declines. Because the breakout energy increases with the length of the consolidation, this building produces a strong sense of anticipation.

Both buyers and sellers become wary, waiting for a clear indication before acting. The triangle’s shortening serves as a visual representation of the escalating struggle between the two forces. It is evident which side has ultimately prevailed when the price breaks above or below the converging trendlines.

What Is a Symmetrical Triangle?

A symmetrical triangle is formed when the price contracts between a lower trendline that slopes upward and a higher trendline that slopes downward. As the range gets smaller, volume and volatility gradually decline, suggesting market hesitancy. This pressure eventually builds up and results in a dramatic breakout when buyers or sellers take control.

How the Pattern Forms Step-by-Step 1

Lower Highs (LH)

As the pattern begins to form, each rally becomes weaker than the previous one. Buyers are unable to push the price to new highs, which signals a gradual loss of bullish strength.

Higher Lows (HL)

At the same time, every sell-off becomes less intense. Sellers fail to drag the price to new lows, indicating that bearish pressure is also fading and the market is starting to balance out.

Converging Trendlines

The support and resistance lines start to grow closer together when lower highs and higher lows happen at the same time. The pattern’s triangle structure is visually created by these convergent trendlines.

Volume Drops

Trading volume usually declines as the triangle grows. As traders wait for a clear move, this decline in activity is a good indication that the pattern is correctly forming and indicates market uncertainty.

Breakout Phase

When buyers or sellers gain enough influence, the price eventually leaves the triangle with considerable velocity. This breakout completes the pattern and starts a new trend.

Key Characteristics

When buyers or sellers gain enough influence, the price eventually leaves the triangle with considerable velocity. This breakout completes the pattern and starts a new trend.

1. Two Converging Trendlines

Two trendlines that get closer together as the pattern progresses are what characterize a symmetrical triangle. At least two lower highs create the upper trendline, indicating that purchasers are unable to gradually raise the price.The lower trendline is formed by at least two higher lows, indicating that sellers are no longer able to lower the price. As these points come together, the lines converge to form the triangle shape that indicates compression and reduced volatility.

2. Declining Volume

The consistent decline in trade volume is one of the most crucial features of a symmetrical triangle. Because neither party wants to make significant commitments without a clear direction, market participants become less active as the price tightens.The consolidation phase is confirmed by this volume fall, which frequently comes before the breakout’s eventual rapid climb.

3. Breakout Confirmation

Only when the price breaks out from each side of the triangle is the pattern deemed complete. When the price closes above the upper trendline, indicating fresh purchasing power, this is known as a bullish breakout.When the price closes below the lower trendline, a bearish breakout takes place, signifying that sellers have gained control.Reliable breakout confirmation is provided by a strong, decisive closure beyond the triangle, which is best backed by increasing volume.

4. Works in All Timeframes

The Symmetrical Triangle exists in a variety of time periods and is quite adaptable. The pattern works in the same way whether you are a positional investor, swing trader, or intraday trader.It can be used to identify breakout possibilities in stocks, indices, FX, and even cryptocurrencies because it represents global market behavior.

How to Trade a Symmetrical Triangle

1.Identify the Pattern

It’s important to understand the Symmetrical Triangle’s structure before making a deal. Start by identifying the two converging trendlines, which develop when the market consistently delivers a sequence of lower highs and higher lows.Make sure the swing points are neat and well-defined because disorganized structures can occasionally lead to erroneous breakouts. You should also keep an eye out for decreasing volume, which suggests that the market is undergoing compression and preparing for a potential surge in volatility.

2.Wait for Breakout

When trading this pattern, patience is essential. The market is still in a condition of uncertainty as long as the price stays inside the triangle. Don’t go in too soon.

A.Bullish Breakout

When the price closes firmly above the upper trendline, a bullish breakout takes place. Additional evidence that buyers have acquired momentum is provided by a long bullish candle with rising volume.

B.Bearish Breakout

A bearish breakout occurs when the price closes below the lower trendline, showing that sellers have taken control. Strong bearish volume strengthens the validity of the breakout.

3.Entry Strategies

Aggressive Entry

When the price closes firmly above the upper trendline, a bullish breakout takes place. Additional evidence that buyers have acquired momentum is provided by a long bullish candle with rising volume.

Conservative Entry

Traders who are more conservative wait for the broken trendline to retest. Price frequently returns to the trendline after breaking out before continuing the advance.This offers a higher risk-reward ratio, a tighter stop-loss, and a safer entry.

Target Calculation

Measuring the triangle’s height at its widest point and projecting it from the breakout level is the most accurate method of determining the objective. This guarantees that your goal is in line with the logical price swing potential of the pattern.

Example:

- Triangle height: 40 points

- Bullish breakout at 200 → Target = 240

- Bearish breakout at 200 → Target = 160

This method provides a systematic and predictable way to set profit goals.

3.Stop-Loss Placement

Proper stop-loss placement is essential to protect your capital from false breakouts.

Bullish breakout: Place SL below the most recent swing low or just under the retested trendline.

Bearish breakout: Place SL above the most recent swing high or slightly above the retested breakdown level.

This aligns risk with market structure, helping traders avoid unnecessary losses.

Advantages of Symmetrical Triangle

The Symmetrical Triangle is one of the most dependable and popular chart patterns in technical analysis since it provides traders with a number of significant advantages.

High Accuracy with Strong Breakout Volume

The pattern becomes quite reliable when the breakout is followed by an increase in volume. Strong volume confirms that institutional traders are involved, enhancing the prospects of a sustained advance in the breakout direction.

Easy to Identify on Any Chart

Drawing two trendlines—one linking lower highs and another connecting higher lows—will reveal the pattern, which is visually straightforward. Because of this, it is suitable for novices while yet providing value for experienced traders.

Works Across All Markets

Whether you’re trading stocks, forex, commodities, indices, or cryptocurrencies, the Symmetrical Triangle behaves consistently. Its universal nature makes it a versatile tool for multi-market traders.

Clear Breakout Direction

Although the pattern is neutral by design, the breakout provides a distinct direction. Traders can confidently enter long or short bets as price closes outside the triangle, reducing guesswork.

Provides Measurable Targets

By projecting profit targets based on the triangle’s height, traders have a methodical and objective way to predict future price movement. This facilitates the design of trades with improved risk-reward ratios.

Limitations

- False breakouts are common, especially in low-volume conditions.

- Breakout direction is uncertain until it actually happens.

- The pattern can take a long time to form, requiring patience.

- Retests after breakout may fail, trapping traders.

- Targets may not be reached if momentum fades after breakout.

conclusion

An impending breakout is indicated by the Symmetrical Triangle, a powerful continuation pattern.Use appropriate stop-loss and objectives, wait for a volume-backed breakout, and be patient during consolidation.When traded with discipline, it becomes a highly reliable setup.

Frequently Asked Questions

1. What is a Symmetrical Triangle Pattern?

A Symmetrical Triangle is a chart pattern where the price forms lower highs and higher lows, creating two converging trendlines that point toward each other.

2. What does the pattern indicate?

It signals a period of consolidation and indecision in the market. The breakout can occur in either direction—upward or downward.

3. Is the Symmetrical Triangle bullish or bearish?

It is a neutral pattern. The direction of the breakout determines whether it becomes bullish or bearish.

4. How do traders confirm the breakout?

A valid breakout happens when the price closes outside the triangle with strong volume—either above the upper trendline or below the lower trendline.

5. How is the target price calculated?

Measure the height of the widest part of the triangle and project that distance from the breakout point to estimate the potential move.

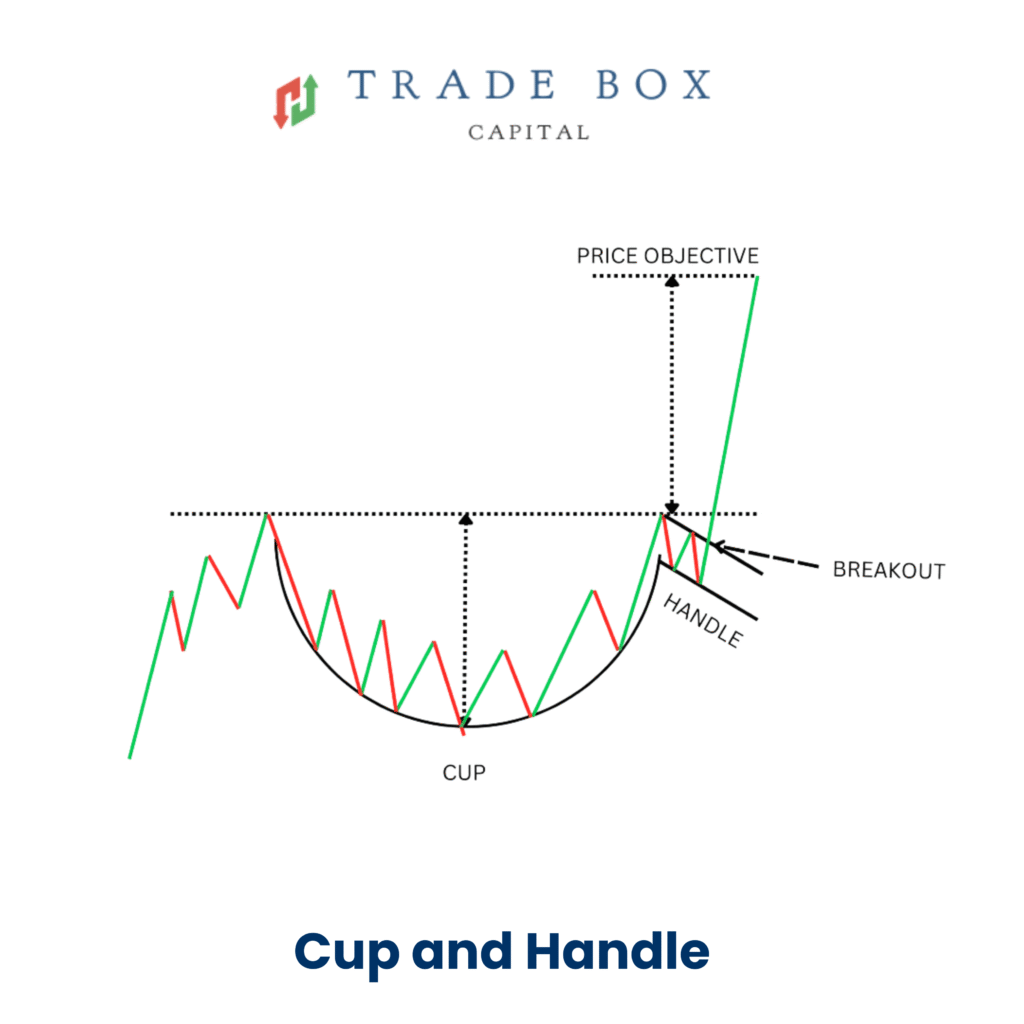

What is the Cup and Handle Pattern?

The Cup and Handle is a bullish continuation pattern that forms during an uptrend and resembles a tea cup. The cup is created when the price slowly declines, forms a smooth rounded bottom, and then rises back toward the previous high.This “U-shaped” structure reflects a healthy correction where sellers gradually weaken and buyers regain strength, showing strong accumulation in the market.

After the cup completes, the price faces resistance near the prior high and pulls back slightly to form the handle. This handle is a small consolidation or dip that shakes out weak traders before the next move. significant volume when the price breaks out above the handle indicates that the uptrend will continue and frequently results in a significant upward rise.

Structure of the Cup and Handle

1. The Cup

- Forms when the price enters a steady, rounded correction following an advance.

- Looks like a “U” shape — not a sharp “V” reversal.

- demonstrates how buyers gradually return after sellers temporarily seize control.

Key Characteristics

- Depth: Ideally shallow to moderate (not more than 30–50% correction).

- Symmetry: Left and right sides should be roughly equal.

- Duration: Takes several weeks to months to develop in higher timeframes.

2. The Handle

- After forming the cup, price consolidates sideways or slightly downward.

- Creates a small pullback, typically a flag or small channel.

- This represents the market’s final shakeout before breakout.

Features of a Good Handle

- Forms near the top of the cup.

- Decline should be small (5–15% only).

- Should not drop below the mid-point of the cup.

3. The Breakout

- Occurs when price moves above the handle’s resistance level.

- Breakout is stronger if supported by high trading volume.

- Confirms continuation of the previous uptrend.

How to Trade the Cup and Handle Pattern

Step 1: Identify the Cup

Start by identifying a rounded, smooth U-shaped base that develops following a significant rise. This cup should develop gradually and have a sound correction.Avoid cups that fall too deep or recover too fast, since these often suggest weak purchasing strength or unstable market movement.

Step 2: Identify the Handle

The price typically pulls back a little after reaching the prior high, creating the handle. This handle, a slight decline or tight consolidation, indicates that selling pressure is being absorbed by the market.The handle should stay shallow; if it drops too much, the pattern loses reliability.

Step 3: Wait for Breakout

The crucial confirmation is the breakout. Only when the price clearly breaks above the resistance of the handle and closes above it should you enter the trade. Increased volume during a breakout increases strength and lowers the likelihood of a false move.

Step 4: Set Stop-Loss

Use a suitable stop-loss to safeguard your position. The safer stop-loss is below the handle’s low, as breaking this level invalidates the pattern.A deeper but more conservative stop-loss can be put below the midway of the cup, offering greater space for market changes.

Step 5: Set Target Price

Measure the depth of the cup (from the top to the lowest point) to determine the objective. Add this amount to the breakout level from the handle.This forecast objective provides a reasonable estimate of the potential length of the advance following the breakout.

What Makes the Cup and Handle Powerful?

Shows Strong Accumulation

The slow formation of the spherical cup shows that major investors are gradually increasing their interests. This ongoing buying pressure strengthens the foundation for a strong breakout.

Low-Risk, High-Reward Structure

The handle creates a narrow stop-loss region because it is a modest and controlled pullback. This means traders risk very little while targeting a much higher upside move, enhancing risk-to-reward ratios.

Performs Best in Bullish Trends

The pattern works extremely well in markets that are already trending upward. After the cup’s correction and the handle’s consolidation, the breakout often triggers a continuation of the larger trend with strong momentum.

Common Mistakes in Trader

Misreading V-Shaped Cups

Although a fast V-shaped recovery could resemble a cup, the pattern is unreliable because it lacks the slow accumulation required for a powerful breakout.

Entering Before Breakout

Many traders jump in as soon as they see the handle forming. Without a confirmed breakout above the handle resistance, the pattern can easily fail.

Ignoring Volume Confirmation

A true Cup and Handle breakout should come with noticeable volume. Low-volume breakouts often lead to false moves and quick reversals.

Trading Deep or Oversized Cups

If the cup is too deep, it shows that sellers dominated too strongly. These patterns usually lack momentum and have a lower success rate.

Advantages of the Cup and Handle Pattern

- High Reliability in Uptrends: Performs well in strong bullish markets.

- Clear Entry & Exit Points: Breakout and stop-loss levels are straightforward to determine.

- Easy to Spot: It is visually simple to identify the cup and handle shape.

- Multi-Timeframe Friendly: Suitable for daily, weekly, and even monthly charts.

Limitations of the Cup and Handle Pattern

- Slow to Form: Particularly on longer durations, the pattern may take a while to emerge.

- False Breakouts: Low-volume markets often exhibit breakouts that fail.

- Deep Cups Decrease Reliability: Weaker buying power is indicated by very deep corrections.

- Weak Handles: The pattern becomes invalid if the handle falls too low.

Conclusion

The Cup and Handle is a reliable bullish continuation pattern showing that the market paused but did not reverse. It reflects steady buyer accumulation, and once the breakout occurs, it often leads to a strong rally. By identifying the pattern correctly and waiting for confirmation, traders can capture high-probability, low-risk opportunities.

Frequently Asked Questions

1. What is a Cup and Handle pattern?

The Cup and Handle is a bullish continuation pattern that shows a period of consolidation (cup) followed by a small pullback (handle) before price breaks out upward.

2. How do I identify a Cup and Handle pattern?

Look for:

A rounded bottom forming the cup

A small downward or sideways pullback forming the handle

A breakout above the resistance (the cup’s top)

3. What does the pattern indicate?

It signals bullish momentum and suggests the price may move higher after the breakout.

4. How do traders use this pattern?

Traders often enter after a confirmed breakout above the handle resistance and set targets based on the cup’s depth.

5. Is the Cup and Handle pattern always reliable?

No. False breakouts can happen. Traders often confirm with volume, trend direction, and other indicators to increase accuracy.