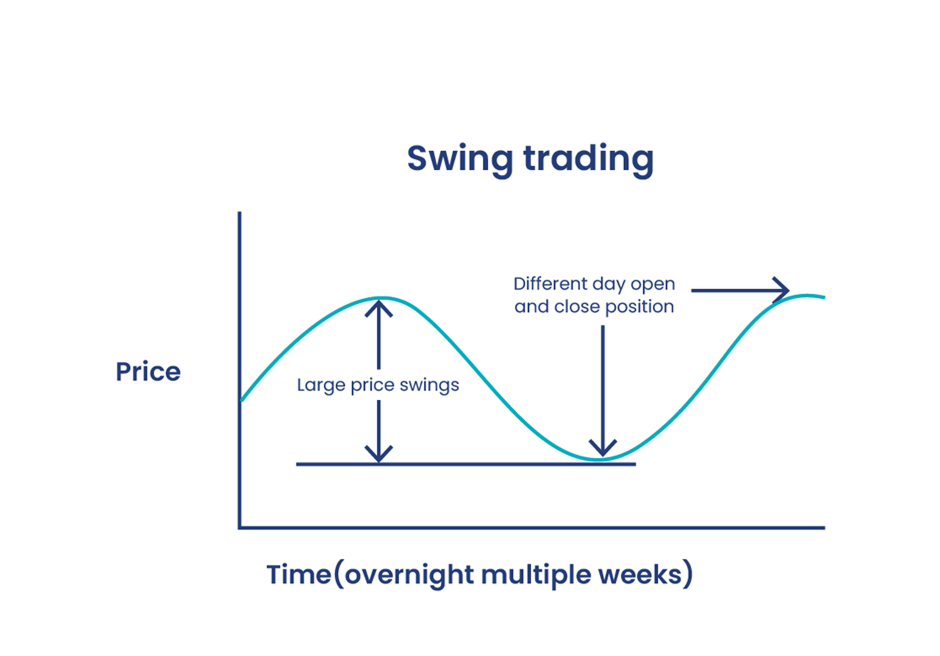

Swing trading is a type of trading that falls somewhere between day trading and long-term investing. Unlike day trading, swing traders hold their positions for several days or even weeks, aiming to profit from “swings” in the market.

How its works

Swing traders focus on capturing a portion of an expected price move. While day traders look at minute-to-minute price changes, swing traders look at trends that play out over several days.

This is considered one of the most profitable trading types that allows more flexibility, as you don’t need to be glued to your computer screen all day.

Techniques

Some effective swing trading techniques include

Trend Following

This involves identifying the overall direction of the market and making trades that align with this trend. If the market is trending upwards, for example, a swing trader might look to buy stocks that are expected to continue rising.

Support and Resistance

Swing traders often use support and resistance levels to make trading decisions. They might buy when a stock’s price bounces off a support level or sell when it hits resistance.

Technical Indicators

Like day traders, swing traders also rely on technical analysis, but they focus on longer timeframes, such as daily or weekly charts.

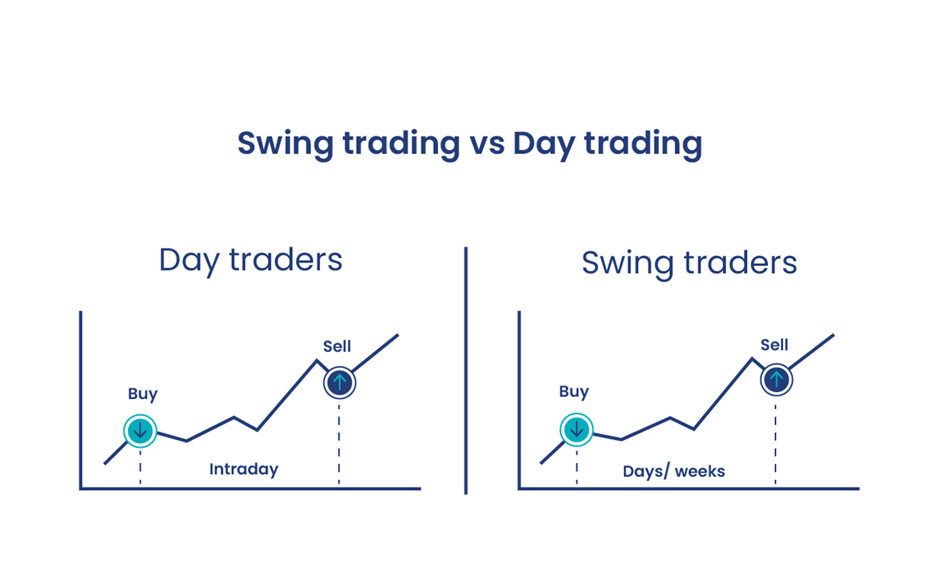

Swing Trading vs Day Trading

The main difference between swing trading and day trading is the time horizon. Swing trading is less time-intensive and allows for more considered decision-making, making it a good option for those who can’t dedicate their entire day to trading.