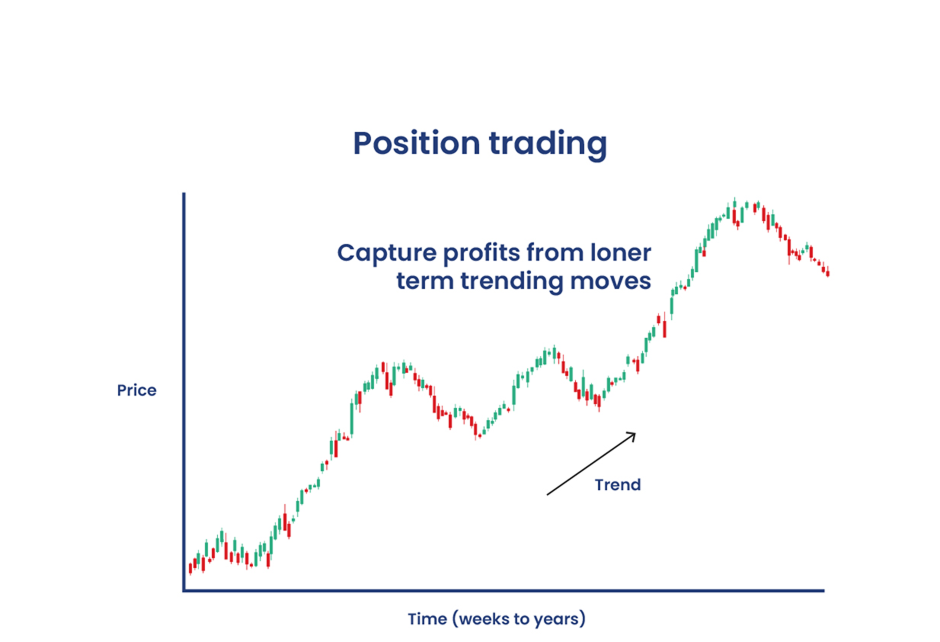

Position trading is a long-term approach that involves holding positions for weeks, months, or even years. This best type of trading is more akin to investing, as it relies on fundamental analysis and long-term market trends.

How its works

Position traders aim to profit from large price movements over an extended period. They are less concerned with short-term market fluctuations and more focused on the overall direction of a stock or market.

Because this type of stock trading involves holding positions for a long time, it’s crucial to thoroughly understand the underlying asset and its growth potential.

Strategies

Some of thebest trading type strategies for position traders include

Buy and Hold

This strategy involves buying a stock with the expectation that it will increase in value over time, regardless of short-term market movements.

Trend Following

Like swing traders, position traders often follow trends but on a much longer timeframe. They might hold onto a stock for several months or even years if the trend is strong.

Fundamental Analysis

Position traders rely heavily on fundamental analysis, evaluating a company’s financial health, industry position, and economic conditions to make their decisions.

Short-Term vs. Long-Term Trading

Position trading contrasts sharply with short-term trading styles like day trading and scalping. It’s better suited for those who prefer a more hands-off approach and are comfortable with the patience required to see their trades through.