What is a Trendline?

A trendline is a straight line that indicates the dominant direction of price movement and is drawn over pivot highs or under pivot lows. An uptrend is shown when the line slopes upward, indicating that buyers are in charge. It indicates a declining trend and implies that sellers are in control when it slopes downward.

Use of Trendline

They are used by traders to ascertain the trend’s direction, possible reversal zones, and support and resistance levels. Traders often use them to corroborate entry and exit positions or to validate other technical indicators.

How to Draw Trend Lines

Connect at least two notable highs or lows on the chart to create a trendline. The trendline gets stronger and more dependable as more points line up with it.

How To Draw Trendline in Chart

Identify swing highs (for resistance lines) or swing lows (for support lines) in any price chart. To predict future price behavior, draw a line through these locations and extend it to the right.

A trendline is one of the most powerful tools in technical analysis. It helps traders quickly identify the overall direction of the market — whether the price is moving up, down, or sideways.

1.Identify the Trend Direction

Before drawing a trendline, observe whether the chart is making:

Higher highs & higher lows → Uptrend

Lower highs & lower lows → Downtrend

This tells you which type of trendline to draw.

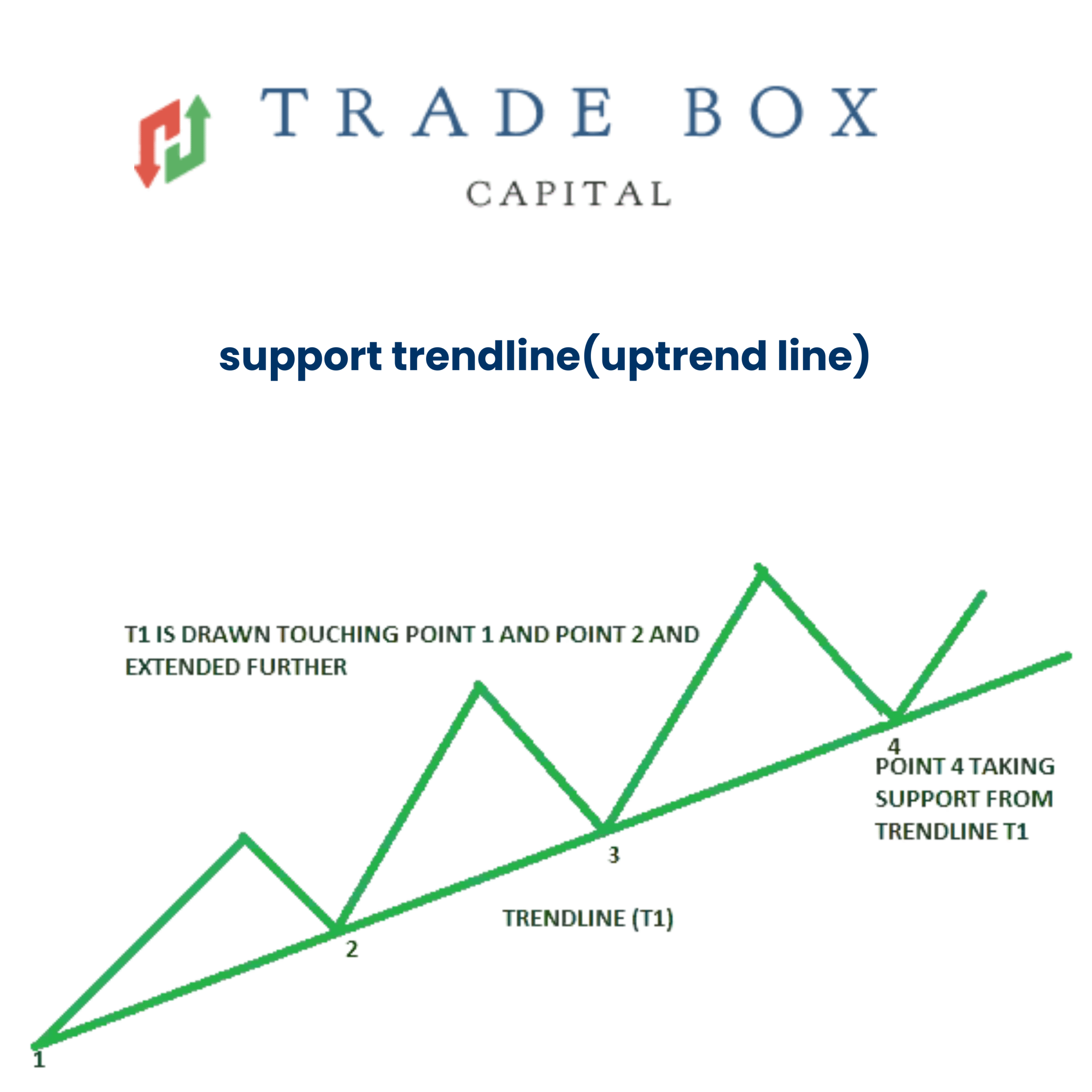

Draw an Uptrend Line (Support Line)

An uptrend trendline is drawn by:

- Connecting two or more higher lows

- Drawing the line below the price

- Extending the line to the right

This line acts as support, showing levels where buyers entered previously.

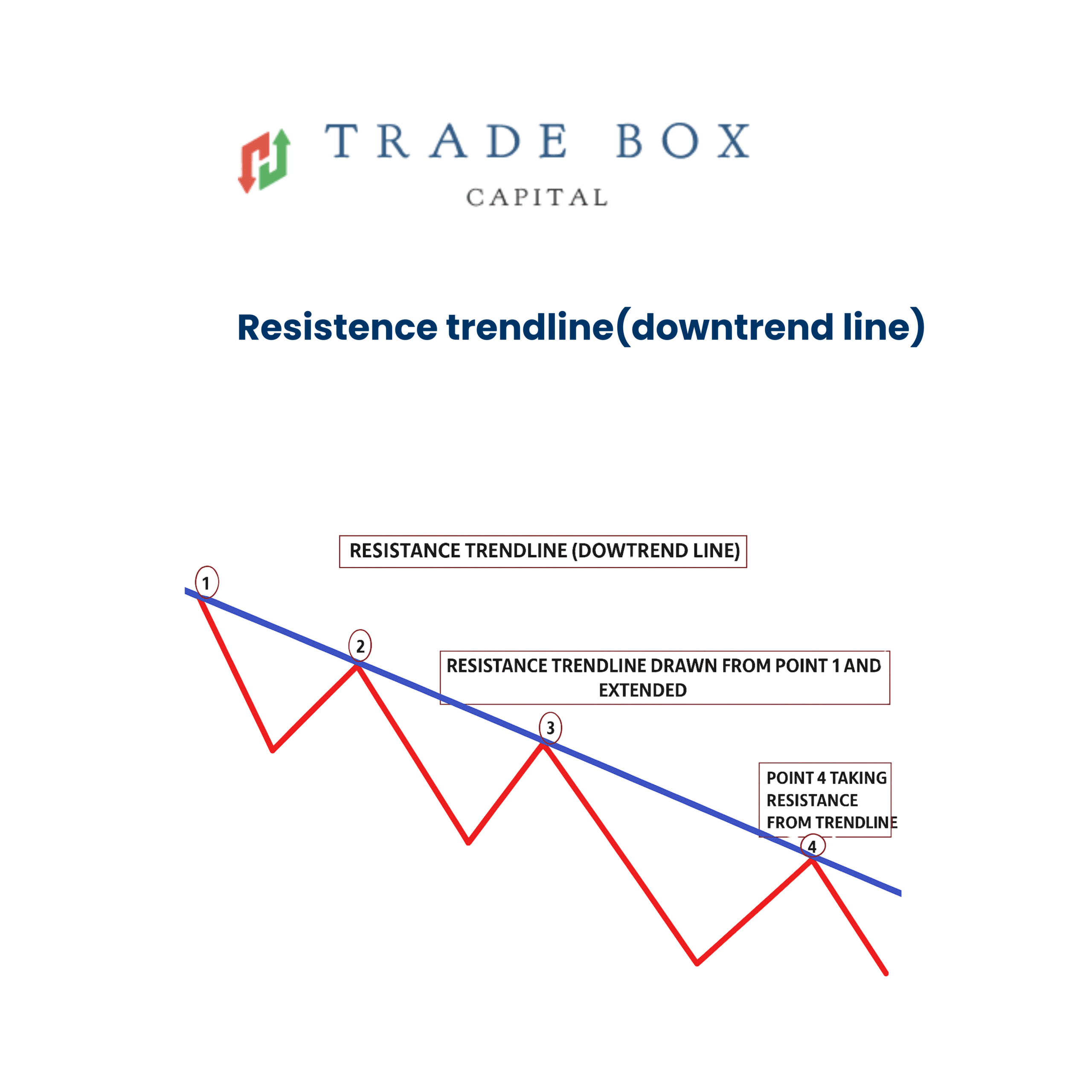

Draw a Downtrend Line (Resistance Line)

A downtrend trendline is drawn by:

- Connecting two or more lower highs

- Drawing the line above the price

- Extending the line to the right

This line acts as resistance, showing where sellers controlled the price.

The Trendline Must Touch at Least Two Points

For a valid trendline:

Minimum 2 touches = basic trendline

3 or more touches = stronger, more reliable trendline

Use Trendlines to Predict Market Behavior

Trendlines help traders

- Identify potential buy and sell

- Spot breakouts and

- Understand market

- Confirm trend strength

If the price breaks a strong trendline, it may signal:

Trend reversal, or

Temporary correction

Avoid Common Mistakes

- Forcing the trendline to fit

- Drawing lines through candlestick bodies (use wicks)

- Using only one point

- Drawing trendlines on very noisy charts

How To Draw Trend Line in Candlestick Chart

Use the body or wick of candles that contact the highs or lows to establish trendlines on a candlestick chart. To validate the trend, connect at least two points, but preferably three. Use the same method as for other charts, but because candlestick charts include open, high, low, and close data, they provide greater visual signals.

Summary

In chart analysis, trendlines are straightforward but crucial tools. They assist traders in determining prospective entry and exit locations, predicting future reversals, and comprehending the direction of the market. Anyone interested in technical trading must learn how to draw trendlines.

Frequently Asked Questions

1.What is the purpose of a trendline?

A trendline helps traders visualize the general direction of price movement and potential support or resistance levels.

2. How many points are needed to draw a trendline?

At least two points are needed, but three or more make it more reliable.

3. Can trendlines be used in all time frames?

Yes, trendlines can be drawn on any time frame — from 1-minute to monthly charts — depending on your trading style.

4. What happens when a trendline breaks?

A break in a trendline may signal a trend reversal or loss of momentum in the current direction.

5. Which is better — using wicks or candle bodies for drawing trendlines?

It depends on preference, but wicks are often used for precision while bodies are used for cleaner, clearer analysis.

Introduction

One of the best methods for spotting trading opportunities is a trendline. They assist traders in seeing the trend of the market and making well-informed judgments on what to purchase or sell. Trendlines show the underlying momentum—whether prices are going higher, downward, or consolidating—by joining important price points.

Using Trend Lines as Support or Resistance

A trendline acts as resistance in a downward trend and as support in an upward trend. When the price approaches a rising trendline, it usually rises, indicating buying pressure. However, when prices approach a negative trendline, they usually face selling pressure. Traders can use these reactions to enter trades around support or resistance when stop-loss levels are clearly specified.

Trendline Breakout Strategy

When the price clearly climbs above or below a trendline, this is known as a trendline breakout. This may indicate that the trend is either continuing or reversing. A bullish period may begin when prices break above a descending trendline. A negative move may also be indicated by a break below an upward trendline. Strong momentum and higher trade volume might occasionally signal a breakout.

Aggressive Entry

Aggressive traders often enter a trade immediately following a breakout. For instance, if a stock breaks over a resistance trendline, it can go long without waiting for confirmation. This approach offers more potential returns, but it also carries a higher risk because of the potential for false breakouts.

Conservative Entry

Aggressive traders often enter a trade immediately following a breakout. For instance, if a stock breaks over a resistance trendline, it can go long without waiting for confirmation. This approach offers more potential returns, but it also carries a higher risk because of the potential for false breakouts.

Be Cautious with Trend Line Breaks

Not all breakouts are genuine.When prices briefly rise above a trendline before retracing once more, this is known as a false breakout. To avoid traps, traders should look for indicators like RSI or MACD, candlestick patterns, or confirmation indications like volume surges. To prevent unforeseen reversals, always use stop-loss orders.

Key Takeaways

- Support, resistance, and market direction can all be found using trendlines.

- New trading opportunities are frequently indicated by breakouts above or below trendlines.

- Although they carry greater risk, aggressive entries grab early moves.

- Conservative entries are less rewarding but offer more confirmation.

- Always use volume or other indicators to confirm breakouts.

Frequently Asked Questions

1.Can trendlines work in all timeframes?

Yes, trendlines can be applied on any chart timeframe — from intraday to long-term investing — depending on your strategy.

2. How do I confirm a breakout?

A breakout is confirmed by strong volume, clear price movement beyond the trendline, and possibly a retest of the line.

3. Is it better to trade aggressively or conservatively?

It depends on your risk tolerance. Aggressive entries suit risk-takers, while conservative entries are safer for patient traders.

4. What is a false breakout?

A false breakout happens when the price crosses a trendline briefly but then reverses direction, trapping traders who entered early.

5. Should I combine trendlines with other indicators?

Yes, combining trendlines with indicators like RSI, MACD, or moving averages improves accuracy and reduces false signals.

Trading Support and Resistance Levels

The fundamental concepts of support and resistance levels in technical analysis help traders identify potential turning points in the market. These levels on a chart represent areas that the price has historically had trouble moving through. The timing of market entry and departure can be greatly improved by understanding and applying these levels.

Understanding Support Levels

A price range where a decreasing market typically stops and starts to rise again is known as a support level. This occurs because there is a “floor” for the price at that point due to an increase in buying interest. In anticipation of a price recovery, traders frequently seek to purchase close to support levels. A decline may begin if a support level breaks.

Reading Support and Resistance Levels on a Chart

To locate these levels, search for previous highs and lows, horizontal zones, or trendlines where the price has often reversed. Support and resistance can also be indicated by moving averages, Fibonacci retracement levels, and psychological round numbers like $100 or ₹10,000. The more times a level is tested without failing, the stronger it becomes.

Advantages of Support and Resistance

A trendline is a straight line that connects multiple price points, helping traders visualize the direction and strength of a trend. It’s a key tool for support and resistance.

5. Why is Trend Analysis Important in Trading?

- Helps identify entry and exit points for trades.

- Improves risk management by setting stop-loss and take-profit zones.

- Enhances accuracy when combined with indicators like RSI or moving averages.

- Works across different timeframes and market types.

- Disadvantages of Support and Resistance

- Not always precise — prices may slightly break through levels before reversing.

- Can produce false signals during high volatility or news events.

- Requires practice and confirmation from other technical tools.

Nutshell

Support and resistance explain how the price moves at specific levels and are an essential part of trading. By becoming proficient with them, traders may predict potential reversals, follow trends consistently, and improve their overall trading performance.

Frequently Asked Questions

1. What causes support and resistance levels to form?

They form due to market psychology — areas where buyers or sellers historically reacted strongly.

2. Can support become resistance?

Yes. When the price breaks below a support level, it can act as resistance when retested.

3. Do support and resistance levels work in all timeframes?

Yes, they are effective from 1-minute to monthly charts, depending on your trading style.

4. Are these levels reliable in volatile markets?

They can still work, but confirmation with indicators or volume is recommended.

5. How many times can a level hold?

The more times a level is tested without breaking, the stronger it becomes.

How to Identify Support and Resistance Levels

Support and resistance levels can be identified by looking at historical price data. Traders look for price ranges where the market has regularly reversed. Common tools include trendlines, moving averages, volume analysis, Fibonacci retracements, and psychological price zones (like round numbers). These methods help identify locations with a high demand for sales or purchases.

The Significance of Recognizing Support and Resistance Levels

Recognizing these levels enables traders to accurately analyze market behavior, predict reactions, and plan entrances or exits. When a level remains stable, it denotes strength; when it breaks, it signifies a shift in momentum. These reactions help us comprehend market sentiment and trend direction.

Risk Management

In risk management, levels of support and resistance are crucial. To reduce losses, traders frequently set stop-loss orders above resistance or below support.This guarantees disciplined trading and defense against erratic market fluctuations.

Trade Entries and Exits

Traders can efficiently time entry and exit points by examining how prices move around these levels.While breakouts offer chances for trend-following trades, buying near support or selling near resistance permits high reward-to-risk ratios.

Volatility Indicators

When price swings become more severe in unpredictable market conditions, support and resistance zones enlarge.During uncertain times, traders can adjust their techniques and prevent overexposure by keeping an eye on these zones.

Psychological Significance

Market psychology is reflected in both support and opposition. They are strong self-reinforcing zones since many traders keep an eye on the same levels. Emotions like fear and greed frequently trigger reactions when prices go close to these regions, affecting market results.

Drawbacks of Support and Resistance in Trading

Support and resistance levels are crucial, but they are not always reliable. Price behavior might diverge from expectations due to market dynamics, unforeseen news, and volatility.

Subjectivity and Interpretation:

- Subjective analysis may result from traders drawing support and resistance lines in different ways.

- Conflicting trade signals or inconsistent results are frequently the result of this volatility.

Non-Foolproof Nature

- Strong market moves or news developments can cause support and resistance levels to collapse.

- Losses may occur if one relies solely on support and resistance levels without verification.

Self-Fulfilling Prophecies

- They often succeed because so many traders embrace and act upon these levels.

- Collective trading action strengthens the expected price response.

Ineffectiveness in Volatility

- In volatile markets, prices can quickly break through multiple levels.

- It can be challenging to distinguish between genuine breakouts and false signals as a result.

- In volatile markets, prices can quickly break through multiple levels.

- It can be challenging to distinguish between genuine breakouts and false signals as a result.

Necessity for Supplementary Indicators

- Combining support and resistance with tools like RSI, MACD, or volume improves accuracy.

- By eliminating false signals, this confirmation improves decision-making.

Trading Tips

- Always confirm breakouts with volume.

- Use multiple timeframes for stronger validation.

- Set stop-loss orders beyond key levels.

- Combine SR levels with momentum indicators.

- Avoid overtrading during high volatility.

Frequently Asked Questions

1. Why are support and resistance important in trading?

They help identify key price levels where reversals or breakouts are likely, improving trade accuracy.

2. Can support and resistance levels change over time?

Yes. As market trends evolve, old levels may lose relevance while new ones form.

3. Are SR levels reliable for all asset types?

Yes, they can be applied to stocks, forex, commodities, and cryptocurrencies.

4. What happens when price breaks a strong resistance?

It often signals bullish momentum and the start of a new uptrend.

5. Should beginners rely only on SR levels?

No. It’s best to use them with other indicators and confirm signals before entering trades.

Effects, Advantages, and Disadvantages of Trading as Price Leaves Support and Resistance Levels

A shift in market sentiment or momentum is frequently indicated when the price departs a level of support or resistance. Because these movements may signal a false move (brief breakout before reversal) or a breakout (strong continuation), traders keep a close eye on them.A Comprehending these impacts enables traders to identify early trend changes and efficiently schedule inputs or exits.

The Switching of SR Levels

When a level of support is broken, it frequently becomes new resistance, and when a level of resistance is broken, it frequently becomes new support. Due to shifting trader psychology, this phenomenon—known as the switching of SR levels—occurs; former sellers may turn into buyers and vice versa.

Advantages of Trading as Price Leaves SR Levels

- Opportunities for early entry: Traders can identify emerging trends early on.

- High profit potential: Strong, long-lasting price moves can result from breakouts.

- Clear invalidation points: Stop-loss levels can be positioned slightly outside of SR zones that have been broken.

- Better confirmation: When retested levels hold, it reinforces the strength of the new trend.

The Perception of Supply and Demand

Levels of support and resistance show how supply and demand are balanced. Strong demand is indicated when the price goes away from support because there are more buyers than sellers. On the other hand, when the price breaks through resistance, the market is dominated by sellers and there is more supply. The direction of the market is shaped by this ongoing change.

Disadvantages of Trading as Price Leaves SR Levels

- Traders are frequently caught on the wrong side by false breakouts.

- Premature stop-loss hits may result from high volatility around these levels.

- To differentiate between genuine and fraudulent breakouts, one needs experience and validation tools.

- Unexpected technical setups can be invalidated by sudden news occurrences.

Nutshell

Trading as prices depart support and resistance levels can be successful, but it takes patience, confirmation, and careful risk management. Recognizing SR switching and understanding supply and demand dynamics might provide traders with a competitive advantage when finding actual breakout opportunities.

Frequently Asked Questions

1. What happens when price breaks support or resistance?

It often signals a new trend direction or continuation of momentum.

2. Why do SR levels switch roles?

Because traders’ perception of value changes — buyers become sellers and vice versa.

3. How can traders confirm a true breakout?

Use indicators like volume, moving averages, or candle closing beyond the SR zone.

4. Are false breakouts common?

Yes, especially in low-volume or sideways markets.

5. Should beginners trade breakouts?

Only after learning to identify strong SR zones and confirming moves with reliable signals.